2011年07月11日 07:43

来源: 金融界网站

金融界网站讯 据港媒报道,内地CPI 在6 月上升了6.4%,创下08 年以来新高;不过,《信报》首席顾问曹仁超在本报举办论坛上指出,CPI 在今年第三季已见顶,预期CPI 将由7月起逐步回落。他指出,内地将在7 月至8 月再一次上调存款准备率,人民币亦会加息多一次,届时内地银根收紧期才会完结。

至于全球下半年的投资环境,曹仁超指出,全球农业产品会再次进入丰收期,令农产品价格下跌,或会影响农产品股的表现。至于油价,曹仁超认为,油价和矿产价格上升的趋势将结束,并进入平稳期。对于美国经济,曹仁超表示,不相信美国将出现双底衰退,指出美国联储局主席贝南奇已利用货币政策消除美国双底衰退情况。

谈到选股,除味千中国(538)和六福集团(行情,资讯,评论)(590)等内需概念股外,曹仁超下半年看好高科技股,因为国家的「十二.五」规划支持高科技行业发展;另一方面,由于内地大幅度加薪,曹仁超看淡劳工密集的工业股。至于资源股,曹仁超认为会个别发展,内地银行股则进入收紧期。

赵善真:无必要保留联汇

now 财经台资深评论员赵善真表示,看好高科技股,但他提醒地缘政治的紧张关系,将影响中国的经济政策。至于香港的经济环境,赵善真认为,贫富悬殊、经济底子薄弱、财团大举北移等因素,已开始削弱香港的优势。

另外,赵善真认为没有需要保留联系汇率, 「还要联系汇率做什么?」他又指「不解决联系汇率解决不了通胀」;即使取消联系汇率,本港的楼价亦不会有太大改变。

他表示,本港楼市有三至四成是内地客,但由于人民币升值,在内地客眼中,香港楼价便宜,而且正在下跌。他又指,供求决定资产价格,但香港楼市现时的供应量少,08、09 年只有八千至九千个单位落成,加上息口低,令香港的楼价不断攀升。

Source/转贴/Extract/Excerpts: 金融界

Publish date:11/07/11

Be decisive, Be patient, Don’t be greedy, Don't be stubborn

Disclaimer

如果要翻译这个网站,请使用google translate http://translate.google.com

The information contained in is provided to you for general information/circulation only and is not intended to nor will it create/induce the creation of any binding legal relations. The information or opinions provided do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should seek advice from a financial adviser regarding the suitability of the investment products mentioned, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to purchase the investment product. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest.

Any views, opinions, references or other statements or facts provided in this are personal views. No liability is accepted for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on the information provided herein.

Personal Data Protection Act (PDPA)

You would like this website to collect your personally identifiable information that can be used to contact or identify you (“Personal Data”). Personal Data may include, but is not limited to:

- Your name, email address and phone number.

You acknowledge and consent to our collection of your personal data for contacting you on the purposes listed below:

- Marketing, advertising and promotional purposes related to the content of this website

- Provision of products & services which you have requested for

Please note that you are entitled to withdraw your consent for the collection of your personal data at any point in time by providing a notification to ckchoy77@gmail.com.

Note:

All TA (Technical Analysis) view using charts are for illustration purpose only.

Unless otherwise specified, all charts' sources are from POEMS(Phillip Online Electronic Mart System)

Friday, 15 July 2011

Tuesday, 12 July 2011

Recipe for a US stock rally?

The Star Online > Business

Monday July 11, 2011

Recipe for a US stock rally?

Profit growth of US firms can still be strong in second quarter

NEW YORK: Wall Street heads into earnings season this week playing a typical game: Worrying about results a lot, and then rallying on pleasant surprises.

Analysts have been lowering earnings estimates of late and nervousness about the US economic picture abounds, especially after Friday's poor June jobs report.

However, profit growth could still be strong in the second quarter and that could boost stocks. The Standard & Poor's 500 fell 0.4% in the second quarter, but rallied in recent days on hopes for economic improvement.

Over the last month, analysts have revised downward their earnings estimates for S&P 500 companies, with the mean change in earnings estimates a negative 6.4%, according to Thomson Reuters StarMine data.

“I think there's going to be a lot of anxiety going into it, and I think companies are going to continue what they've done for the last few quarters: Put out better-than-expected numbers, and guidance should be OK,” said Scott Billeaudeau, portfolio manager at Fifth Third Asset Management, in Minneapolis.

S&P 500 components' earnings were expected to have increased an average of 7.3% in the second quarter from a year ago, down from first-quarter growth of 18.9%, Thomson Reuters data showed.

But the number could jump if most companies beat analysts' forecasts. Early estimates for first-quarter profit growth were at about 13%.

“The general economic data is suggesting some softness in the overall economy both globally and in the US. So that drives somewhat more realistic expectations for companies,” said Natalie Trunow, chief investment officer of equities of Calvert Investment Management in Bethesda, Maryland, which manages about US$14.8bil.

In the coming week, the Federal Reserve will release minutes of its June 21-22 policy-making meeting. Among the US economic indicators on tap are June retail sales, June inflation readings from the United States. Producer Price Index and the US Consumer Price Index, industrial production and capacity utilisation for June, and the preliminary July reading on consumer sentiment from the Thomson Reuters/University of Michigan Surveys of Consumers.

Financial services companies have seen the biggest downward revisions in earnings estimates in the last 30 days, with banks taking some of the biggest hits, including Goldman Sachs and Morgan Stanley.

JPMorgan Chase will be the first of the big banks to report, with results due on Thursday. Results from top tech player Google also are expected on Thursday, while aluminum company Alcoa unofficially starts the season with earnings after the bell on Monday.

The S&P financial index dropped 6.3% in the second quarter as worries escalated about the impact of the eurozone debt problems on the global economy. The mean change for earnings estimates in the sector in the last 30 days was a negative 34.4%, StarMine data showed.

Disasters and disappointments

Analysts have also said the aftermath of Japan's earthquake, months of extraordinary weather in the United States, and rising food and commodity prices took a toll on companies in the second quarter.

StarMine analysis showed companies, including Platinum Underwriters Holdings, were likely to disappoint with results because of tornado damage claims.

But companies had kept costs in check and that should support stronger results, while also giving a boost to stock prices, he said.

“I think things underneath the macro, global, political noise continue to percolate,” said Mike Jackson, founder of Denver-based investment firm T3 Equity Labs. But “you're going to see higherquality companies showing the surprises this quarter (versus) last.”

Based on his own analysis, he expects industrials and utilities to surprise to the upside, especially for companies involved in “machinery, and roads and rails” and for electric utilities.

On the flip side, he sees a high probability for earnings disappointments in healthcare, consumer staples and materials sectors.

An S&P healthcare index led gains in the S&P 500 in the first half of the year as the market shifted to defensive shares, with the sector up 14% since the start of the year, followed by an S&P energy index, up 11%.

The healthcare sector may be subject to profit-taking once earnings start after its strong run so far this year, according to Tobias Levkovich, Citigroup's chief US equity strategist, who made the point in a research note.

Some analysts expect total upside surprises to be less than in previous quarters, with the percentage of companies beating expectations likely to fall in the mid-60s percentage range, below the 70% range, where it has been.

S&P 500 earnings overall could beat estimates by a “modest” 1% to 3%, Charles Blood, senior market strategist at Brown Brothers Harriman, wrote in a research note.

“Margins typically rise in the second quarter, but our primary concern and one of the biggest investment debates, is, How much room do companies have for further improvement?'” he wrote. - Reuters

Source/转贴/Extract/Excerpts: The Star Online

Publish date:11/07/11

Monday July 11, 2011

Recipe for a US stock rally?

Profit growth of US firms can still be strong in second quarter

NEW YORK: Wall Street heads into earnings season this week playing a typical game: Worrying about results a lot, and then rallying on pleasant surprises.

Analysts have been lowering earnings estimates of late and nervousness about the US economic picture abounds, especially after Friday's poor June jobs report.

However, profit growth could still be strong in the second quarter and that could boost stocks. The Standard & Poor's 500 fell 0.4% in the second quarter, but rallied in recent days on hopes for economic improvement.

Over the last month, analysts have revised downward their earnings estimates for S&P 500 companies, with the mean change in earnings estimates a negative 6.4%, according to Thomson Reuters StarMine data.

“I think there's going to be a lot of anxiety going into it, and I think companies are going to continue what they've done for the last few quarters: Put out better-than-expected numbers, and guidance should be OK,” said Scott Billeaudeau, portfolio manager at Fifth Third Asset Management, in Minneapolis.

S&P 500 components' earnings were expected to have increased an average of 7.3% in the second quarter from a year ago, down from first-quarter growth of 18.9%, Thomson Reuters data showed.

But the number could jump if most companies beat analysts' forecasts. Early estimates for first-quarter profit growth were at about 13%.

“The general economic data is suggesting some softness in the overall economy both globally and in the US. So that drives somewhat more realistic expectations for companies,” said Natalie Trunow, chief investment officer of equities of Calvert Investment Management in Bethesda, Maryland, which manages about US$14.8bil.

In the coming week, the Federal Reserve will release minutes of its June 21-22 policy-making meeting. Among the US economic indicators on tap are June retail sales, June inflation readings from the United States. Producer Price Index and the US Consumer Price Index, industrial production and capacity utilisation for June, and the preliminary July reading on consumer sentiment from the Thomson Reuters/University of Michigan Surveys of Consumers.

Financial services companies have seen the biggest downward revisions in earnings estimates in the last 30 days, with banks taking some of the biggest hits, including Goldman Sachs and Morgan Stanley.

JPMorgan Chase will be the first of the big banks to report, with results due on Thursday. Results from top tech player Google also are expected on Thursday, while aluminum company Alcoa unofficially starts the season with earnings after the bell on Monday.

The S&P financial index dropped 6.3% in the second quarter as worries escalated about the impact of the eurozone debt problems on the global economy. The mean change for earnings estimates in the sector in the last 30 days was a negative 34.4%, StarMine data showed.

Disasters and disappointments

Analysts have also said the aftermath of Japan's earthquake, months of extraordinary weather in the United States, and rising food and commodity prices took a toll on companies in the second quarter.

StarMine analysis showed companies, including Platinum Underwriters Holdings, were likely to disappoint with results because of tornado damage claims.

But companies had kept costs in check and that should support stronger results, while also giving a boost to stock prices, he said.

“I think things underneath the macro, global, political noise continue to percolate,” said Mike Jackson, founder of Denver-based investment firm T3 Equity Labs. But “you're going to see higherquality companies showing the surprises this quarter (versus) last.”

Based on his own analysis, he expects industrials and utilities to surprise to the upside, especially for companies involved in “machinery, and roads and rails” and for electric utilities.

On the flip side, he sees a high probability for earnings disappointments in healthcare, consumer staples and materials sectors.

An S&P healthcare index led gains in the S&P 500 in the first half of the year as the market shifted to defensive shares, with the sector up 14% since the start of the year, followed by an S&P energy index, up 11%.

The healthcare sector may be subject to profit-taking once earnings start after its strong run so far this year, according to Tobias Levkovich, Citigroup's chief US equity strategist, who made the point in a research note.

Some analysts expect total upside surprises to be less than in previous quarters, with the percentage of companies beating expectations likely to fall in the mid-60s percentage range, below the 70% range, where it has been.

S&P 500 earnings overall could beat estimates by a “modest” 1% to 3%, Charles Blood, senior market strategist at Brown Brothers Harriman, wrote in a research note.

“Margins typically rise in the second quarter, but our primary concern and one of the biggest investment debates, is, How much room do companies have for further improvement?'” he wrote. - Reuters

Source/转贴/Extract/Excerpts: The Star Online

Publish date:11/07/11

Wednesday, 6 July 2011

Are you changing your mind?

- 2011,Jul, 1

- Posteado por passiontrader a 00:08:02

Very early in my teenage years, my dad used to tell me that we, men, have to make firm decisions and not change our mind as and when we like. That’s not manly. Only girls do that (sorry ladies…). Been in the trading world for a couple of years, I came to realized that in order to be profitable, you need to trade like a girl! Not only must you change your mind regularly, but must do it quickly!

Changing of mindset is easier said that done. Every traders will have their own feel of where the market is heading, after been bombarded by news and the internet. Once you have that bullish or bearish feeling, it’s very difficult to change even if the market is screaming at you to change. To be successful in trading, we need to be flexible in how we look at the market (I’m still learning to be one!). I remember reading a story about George Soros, one of the most successful hedge fund manager. He was attending a party and was talking to one of his friends about how bullish he was with the market, especially a particular company that he was interested in. A few weeks later, his friend came to know that the company that George Soros was talking about was making a loss and the stock price crashed. Worried about his friend, he called Soros, thinking maybe if he can help him. To his surprise, Soros was very delighted, telling him that he had made a killing with that stock. His friend asked him, “How did you make money when you are bullish about a crashing stock?” George Soros replied, “Oh, I change my mind. I shorted the bugger instead!” Making profitable trades is never easy, especially so in today’s market. To increase the probability of making such trades, not only must we stick to our trading plan, but we must be flexible enough to understand where the market is going. Do not assume that the market will continue to rise/fall when you read a lot of good/bad news about the market. You never know when the market is going to change its mind.

Personal Market View - Market sense 06/07/2011

Today morning marked a second day of profit taking but mostly limited to index stocks/blue chips. Counters especially banks are having a bigger pull back after strong run-up. Kepcorp, Noble, Singtel are pulling back as well. Property counters remain firm.

Since yesterday, the interest on second liners and small caps have been getting stronger. There are many counters in play, just watch the top vol.

A mini bull run may be standing by once sidelines cash are coming back slowly.

Since yesterday, the interest on second liners and small caps have been getting stronger. There are many counters in play, just watch the top vol.

A mini bull run may be standing by once sidelines cash are coming back slowly.

Tuesday, 5 July 2011

Personal Market View - Stocks screen - Sarin, Biosensus

by ckchoy

Stocks screen - Sarin, Biosensus

**Sarin after breaking 0.66 resistance in 26 May, it has been in surging up trend. Today it continue makes new high and closed at 1.075. Looking back its price action from one week ago, there seemed to be accumulation activities below $1. May try your luck to buy below $1. In a short period of time, so far this is a great winner stock, I'm not sure what is the downside risk and how high it will hit but it looks to have a great potential for more upside.(please plot your own graph, as I'm not a TA expert)

**Biosensus is another stock that bucked the profit taking trend today. After hitting 1.28 in the afternoon, it ramped up steadily and closed near high at 1.345. It broke the short term resistance at 1.31 hence in term of TA, it is in good shape now and looking for more upside. The short term support/resistance is 1.28/1.41. Keep an eye of this stock, monitor for a while and decide your entry point. (please plot your own graph, as I'm not a TA expert)

**The views are valid until before 2Q 2011 results announcemnt ( around Jul and Aug 2011). After that the views will be reviewed.

Stocks screen - Sarin, Biosensus

**Sarin after breaking 0.66 resistance in 26 May, it has been in surging up trend. Today it continue makes new high and closed at 1.075. Looking back its price action from one week ago, there seemed to be accumulation activities below $1. May try your luck to buy below $1. In a short period of time, so far this is a great winner stock, I'm not sure what is the downside risk and how high it will hit but it looks to have a great potential for more upside.(please plot your own graph, as I'm not a TA expert)

**Biosensus is another stock that bucked the profit taking trend today. After hitting 1.28 in the afternoon, it ramped up steadily and closed near high at 1.345. It broke the short term resistance at 1.31 hence in term of TA, it is in good shape now and looking for more upside. The short term support/resistance is 1.28/1.41. Keep an eye of this stock, monitor for a while and decide your entry point. (please plot your own graph, as I'm not a TA expert)

**The views are valid until before 2Q 2011 results announcemnt ( around Jul and Aug 2011). After that the views will be reviewed.

Monday, 4 July 2011

名家观点:二次衰退何时到来

●沈联涛

2011/07/04 6:06:46 PM

●沈联涛 香港证监会前主席/大马国行前首席经济学家及助理行长

夏天才刚刚开始,人们已经开始担心全球经济的二次衰退即将来临。

一位朋友发给我一篇“末日博士”鲁里埃尔·鲁比尼(Nouriel Roubini)的文章,标题是《全球衰退的“完美风暴”(The Perfect Storm of a Global Recession)。

虽然这是一篇2008年的文章,文章的论述却同样适用于2011年的情况:欧洲和日本增长放缓,美国呈现就业复苏迹象,包括中国在内的新兴市场国家到达经济增长周期的顶点。

6月13日,鲁比尼在新加坡的一场投资者会议中表示,这场酿造危机的“完美风暴”,有三分之一的可能性将在2013年袭击全球市场。

他最担忧的问题是中国经济硬着陆、日本地震和海啸导致的全球供应链的贸易中断、欧洲债务危机以及美国日益凸显的财政问题。

6月12日,前美国总统经济顾问拉里萨默斯对美国如何避免“失落的十年”的观点,成了《金融时报》的头条新闻。

“失落的五年”

到目前为止,美国已经历了平均年增长率低于1%的“失落的五年”。

萨默斯所担心的是,依赖国内消费推动美国经济增长的渠道,似乎已逐渐枯竭,因此,量化宽松政策所能发挥的作用很有限。事实上,美国家庭终于开始提高他们的储蓄率了,消费的积极性正在下降。

美国国内的问题在于,全球制造业的供应能力,足以满足美国的需求,因此无法推动美国国内制造业的投资。

在某种程度上,日本在全球供应链中受到的冲击和中国的成本上升,有助于美国的企业从外包转为国内生产。

在服务业,就业机会的创造却是有限的,因为需要高端知识的工作,可以通过互联网进行外包。

所以,量化宽松政策产生的短暂复苏,并未带来就业市场的恢复。

至少有三个不利因素制约美国经济的复苏。

第一,失业水平在9%以上居高不下。事实上,由于地方和国家财政赤字,政府至少裁减了50万公务员职位。

第二,平均住房价格再度下滑,有几个州住房贷款负资产达50%。尽管在全国范围内,平均房价自2007年以来下降了20%,但在一些州,房价下降幅度从30%到50%以上不等。

这造成巨大的财富损失,但房价下降的最大影响是对银行不良贷款造成压力。自2007年金融危机以来,美国联邦存款保险公司(FDIC)问题银行名单上的数量已增至888家,总资产将近4000亿美元。

赤字不断上升

第三,美国最大的不确定性是对债务限额及如何处理政府和联邦赤字问题的政治争论。州和地方政府2010年赤字可能上升到1910亿美元,但由于联邦预算的削减,联邦政府对它们的援助将会减少。

美国联邦赤字可以削减多少,是一个极富争议的问题,因为有超过一半的联邦支出用于社会保障及医疗。

共和党希望通过大力削减开支、且不提高税收的办法恢复财政平衡。民主党却认为应提高税收,削减一部分开支。

美联储主席伯南克警告说,尽管还需要国会批准,但是如果不提高联邦政府14.29兆美元债务限额的做法,将“严重扰乱金融市场和支付系统,引起美国政府债券评级的降低,造成对美国信誉的质疑,破坏美元和国库券在全球市场的长期特殊地位”。

储备货币国的信誉,会受到政治局势的影响,这在外国人看来不可思议,但是政治僵局造成技术性违约的风险却并非为零。

在欧洲,希腊债务延期似乎必然发生。这将影响希腊的银行,以及持有大量希腊国债的欧洲主要银行的资本充足率。

由于对希腊债券的持有,集中在欧洲央行和欧洲主要银行,所以重新制定还款计划会比较容易。但是,希腊债务延期将对金融市场造成影响,风险息差必定会上升,投资者信心会受到打击。

鲁比尼的另一担忧,是中国经济硬着陆。

尽管有充足的政府手段来解决中国经济的急剧放缓,但一直依赖于中国和新兴市场不间断的商品需求的全球商品价格,可能会受到剧烈影响。

坠日本式陷阱

《金融时报》专栏作家马丁沃尔夫,已想到中国也可能落入日本式陷阱。

如果美国已经在这个陷阱中,而中国也落入,那整个世界将会陷入困境之中。

五大经济体中,日本经济表现疲弱,德国经济成为出人意料的强大动力,德国尚未受到价格泡沫的重创、且制造业出口增长强劲。这是大多数分析家感到、2011年可以平安度过的原因。

看来,我应该在下一次的专栏文章中讨论马丁·沃尔夫所担忧的问题了。

Source/转贴/Extract/Excerpts: 南洋商报

Publish date:04/07/11

2011/07/04 6:06:46 PM

●沈联涛 香港证监会前主席/大马国行前首席经济学家及助理行长

夏天才刚刚开始,人们已经开始担心全球经济的二次衰退即将来临。

一位朋友发给我一篇“末日博士”鲁里埃尔·鲁比尼(Nouriel Roubini)的文章,标题是《全球衰退的“完美风暴”(The Perfect Storm of a Global Recession)。

虽然这是一篇2008年的文章,文章的论述却同样适用于2011年的情况:欧洲和日本增长放缓,美国呈现就业复苏迹象,包括中国在内的新兴市场国家到达经济增长周期的顶点。

6月13日,鲁比尼在新加坡的一场投资者会议中表示,这场酿造危机的“完美风暴”,有三分之一的可能性将在2013年袭击全球市场。

他最担忧的问题是中国经济硬着陆、日本地震和海啸导致的全球供应链的贸易中断、欧洲债务危机以及美国日益凸显的财政问题。

6月12日,前美国总统经济顾问拉里萨默斯对美国如何避免“失落的十年”的观点,成了《金融时报》的头条新闻。

“失落的五年”

到目前为止,美国已经历了平均年增长率低于1%的“失落的五年”。

萨默斯所担心的是,依赖国内消费推动美国经济增长的渠道,似乎已逐渐枯竭,因此,量化宽松政策所能发挥的作用很有限。事实上,美国家庭终于开始提高他们的储蓄率了,消费的积极性正在下降。

美国国内的问题在于,全球制造业的供应能力,足以满足美国的需求,因此无法推动美国国内制造业的投资。

在某种程度上,日本在全球供应链中受到的冲击和中国的成本上升,有助于美国的企业从外包转为国内生产。

在服务业,就业机会的创造却是有限的,因为需要高端知识的工作,可以通过互联网进行外包。

所以,量化宽松政策产生的短暂复苏,并未带来就业市场的恢复。

至少有三个不利因素制约美国经济的复苏。

第一,失业水平在9%以上居高不下。事实上,由于地方和国家财政赤字,政府至少裁减了50万公务员职位。

第二,平均住房价格再度下滑,有几个州住房贷款负资产达50%。尽管在全国范围内,平均房价自2007年以来下降了20%,但在一些州,房价下降幅度从30%到50%以上不等。

这造成巨大的财富损失,但房价下降的最大影响是对银行不良贷款造成压力。自2007年金融危机以来,美国联邦存款保险公司(FDIC)问题银行名单上的数量已增至888家,总资产将近4000亿美元。

赤字不断上升

第三,美国最大的不确定性是对债务限额及如何处理政府和联邦赤字问题的政治争论。州和地方政府2010年赤字可能上升到1910亿美元,但由于联邦预算的削减,联邦政府对它们的援助将会减少。

美国联邦赤字可以削减多少,是一个极富争议的问题,因为有超过一半的联邦支出用于社会保障及医疗。

共和党希望通过大力削减开支、且不提高税收的办法恢复财政平衡。民主党却认为应提高税收,削减一部分开支。

美联储主席伯南克警告说,尽管还需要国会批准,但是如果不提高联邦政府14.29兆美元债务限额的做法,将“严重扰乱金融市场和支付系统,引起美国政府债券评级的降低,造成对美国信誉的质疑,破坏美元和国库券在全球市场的长期特殊地位”。

储备货币国的信誉,会受到政治局势的影响,这在外国人看来不可思议,但是政治僵局造成技术性违约的风险却并非为零。

在欧洲,希腊债务延期似乎必然发生。这将影响希腊的银行,以及持有大量希腊国债的欧洲主要银行的资本充足率。

由于对希腊债券的持有,集中在欧洲央行和欧洲主要银行,所以重新制定还款计划会比较容易。但是,希腊债务延期将对金融市场造成影响,风险息差必定会上升,投资者信心会受到打击。

鲁比尼的另一担忧,是中国经济硬着陆。

尽管有充足的政府手段来解决中国经济的急剧放缓,但一直依赖于中国和新兴市场不间断的商品需求的全球商品价格,可能会受到剧烈影响。

坠日本式陷阱

《金融时报》专栏作家马丁沃尔夫,已想到中国也可能落入日本式陷阱。

如果美国已经在这个陷阱中,而中国也落入,那整个世界将会陷入困境之中。

五大经济体中,日本经济表现疲弱,德国经济成为出人意料的强大动力,德国尚未受到价格泡沫的重创、且制造业出口增长强劲。这是大多数分析家感到、2011年可以平安度过的原因。

看来,我应该在下一次的专栏文章中讨论马丁·沃尔夫所担忧的问题了。

Source/转贴/Extract/Excerpts: 南洋商报

Publish date:04/07/11

Sunday, 3 July 2011

What next for the market?

The Star Online > Business

Saturday July 2, 2011

What next for the market?

By JAGDEV SINGH SIDHU

jagdev@thestar.com.my

IT'S one thing to worry about all the noise over the economic developments that envelop global markets and quite another to predict how investors will react to them. But there is one overriding common theme caution.

There are many reasons for such apprehension. The year started with the Arab revolution, which led to the political upheaval in many countries in the Middle East and North Africa. Then there were the earthquake and tsunami in Japan that wreaked havoc on the northeastern coast of the country and had repercussions elsewhere given the deep linkages Japanese industries have in the global supply chain.

If they were not enough to ignite worry among investors, the ongoing debt problems in Europe seems to be frothing over as Greece was on the verge of a massive default that would have caused a severe contagion in lenders from Germany and France, two of the EU's largest economies.

In addition, the economic malaise in US persists. At best, the economic indicators are still patchy to suggest that the United States has truly broken away from the gravity of its financial crisis. To infuse more momentum into the US economy, given fears of deflation, the US Federal Reserve embarked on a second round of printing money, called Quantitative Easing 2 (QE2) to the tune of US$600bil. While the move has injected money into the system and helped lift Wall Street, it really has done little for Main Street.

As a consequence of liquidity and growth rates rebounding in emerging markets, commodity prices have surged, lifting inflation and causing another headache for central bankers, governments and consumers world over given the rising cost of living.

The pain is not spread out evenly across all markets.

The FTSE Bursa Malaysia KLCI this week hit a new record high at 1,582.94 on Friday, the third consecutive day it breach record levels. Maybe it reflected the relief over the austerity measures in Greece's bailout plan which were passed amidst tough internal resistance. This lends credence to the long-held belief that when things get tough globally, foreign investors began to appreciate Malaysia's defensive qualities.

With the close of the first half of 2011, pundits are now poring over how the markets will fare in the second half. Given the volatility of markets and the unpredictability of ensuing events, most of them are likely to adopt cautious projections.

Global Fund Manager Survey

One guide to what people who manage money are thinking about is the Bank of America Merrill Lynch fund manager global survey. The latest published survey, which was conducted from June 3-9 on 282 people who managed US$828bil of assets under management, is pointing to money managers favouring less risk.

The survey's risk and liquidity indicator fell to 38, which is below the long-run average of 40 for the first time in nine months.

“The indicator had been relatively resilient so far despite growth concerns,” says the report.

“Equities and commodities weights have been cut with gains for cash and bonds with most of the asset classes very close to their long-run averages.”

The survey discovered that growth and profit expectations stabilised after recent sharp falls as inflation expectations fell dramatically in June from a couple of months ago.

The fund managers felt the global macroeconomic backdrop was not weak enough to warrant more stimulus as three quarters of its panellists thought a recession was unlikely and only 13% expect a new round of QE in the second half.

Despite concerns permeating investment decisions, emerging markets remain the favoured destination among those surveyed.

Although the numbers have slipped from May where 29% of fund managers polled were overweight on emerging markets, the survey revealed that 23% were positive of the prospects of emerging markets in June.

“The cut in emerging market positions comes amid a broad-based rotation towards defensive assets: Global equity allocations are reduced and the average cash level has risen from 3.9% to 4.2%,” says the report.

Investors were favouring markets with domestic demand drivers and as global economic growth is forecast to drop a tad, investors trimmed their positions in cyclical stocks.

Among the most favoured emerging markets are Russia, Indonesia and China.

One painful finding of the survey is this among the emerging markets, Malaysia was the least favoured. But not all equity research houses may concur with that. Goldman Sachs, for one, has an overweight call on Malaysia and given the relative size of the Malaysian market, a handful of such calls would be enough to provide an oomph.

Defying that painful notion further is the fact that Bursa Malaysia hit an all-time high this week. Furthermore, the trading patterns in April and May show that foreign institutional investors were net buyers of Malaysian equities, quite the reverse from their net selling position earlier in February and March. As for domestic institutional investors, the trend was the opposite they were net sellers in April and May but net buyers over the previous two months.

Trading value which stood at RM52bil in January this year is trending downwards towards May which was the lowest for the year at RM31.2bil. Trading volume has also been falling on a monthly basis since January from 39.5 billion units to 18.4 billion units in May.

Largely, local retailers were net sellers for most of the year, only buying more shares than they sold in February.

Crystal ball gazing

What's next for Bursa Malaysia? Given that the exchange is at record levels, pessimism and optimism seem to be locked in a tug-of-war.

MIDF Amanah Investment Bank Bhd senior vice-president and head of research Zulkifli Hamzah says the first half performance was surprisingly resilient which largely bucked the regional trend.

“On closer observation, we would attribute the resilience of the market to foreign buying,” he tells StarBizWeek.

“Foreign investors were net buyers on Bursa Malaysia in 10 of the 13 weeks between March 21 and June 19. We will not be surprised if foreign shareholding on Bursa Malaysia is higher than 22% now, as an estimated RM4.6bil of foreign money had been ploughed into local equity during that period.”

Zulkifli opines that the foreign money flowing into Malaysia involves genuine portfolio funds instead of speculative money seeking quick returns.

“The upgrade of Malaysia's country status from Emerging to Advanced Emerging market by FTSE effective June partly explain the inflow of foreign money, but more importantly, we believe Malaysia is back on the radar screen of many global funds. This augurs well for the market in the second half,” he says.

TA Securities head of research Kaladher Govindan says many of the worries investors had in the first half appear to be winding down and sentiment wise, the second half should be better.

He feels the concerted effort by the EU to tackle the debt crisis in Europe and Japan picking itself out of a recession should help improve market sentiment and anticipates the second half of the year to be a recovery period after a long consolidation period.

“Slower than expected growth in the United States and lingering sovereign debt issues in the US and Europe respectively are expected to drive back funds flow into emerging markets, which will benefit FBM KLCI,” he says.

Zulkifli is maintaining his year end FBM KLCI target of 1,650 points but expects more volatility in the second half.

“The second half is generally wrought with downside surprises, and is also associated with major market corrections. We do not expect the perception to be any different this year,” he says.

Earnings season will be the focus in August and he feels the numbers for the second quarter is expected to remain bad for airlines, shipping, resource-based industries such as gloves, steel and semiconductor.

“If there are any silver linings at all, we expect Malaysia and other resource-rich countries in this region such as Indonesia and Thailand to benefit from the switch out of China and the Asian tigers,” he says.

“China is engineering a slowdown at a scale not seen by an economic super-power. The statutory reserve ratio for its banks is now at a disconcerting 21.5%. More banks will feel the squeeze.”

Citigroup in its note on Malaysia says the upcoming earnings season in August will likely not excite the market.

“The conclusion of the latest results season confirms our view that overall business sentiment appears to have turned cautious as inflationary threat looms with economic activities on low gear,” it says.

Citigroup feels inflation pressure for food and building materials, together with monetary tightening and higher inflation expectations from the electricity price hike could be negative in disposable income and business profitability. It is positive on chemical and consumer stocks and recommends investors take defensive positions in utilities and gaming.

Sectors to watch out for going forward are the oil and gas, plantation and banking, which recorded higher year-on-year earnings growth during the recent quarterly reporting season.

“We expect their positive earnings momentum to continue into the second half of this year,” he says.

His choice of oil and gas stocks is due to higher oil prices which will not only benefit oil majors but also fabricators as well as support service providers as it encourages further upstream and downstream activities.

“Despite the recent sell down, we expect CPO price to remain firm as the global demand for vegetable oils is rather inelastic,” he says.

He thinks earnings growth for banks will be underpinned by healthy loan growth, enhanced fee-based income, lesser provision with improved asset qualities and the rising overnight policy rate (OPR) which cushioned the pressure on margin.

Apart from these sectors, Kaladher is also overweight on construction.

“Players in the domestic-oriented sectors will do well on the back a stronger ringgit and weaker dollar,” he says.

Inflationary environment bodes well for property sector as well as investors switch from holding cash to real estates.”

Exporters that rely heavily on dollar based sales like those in the electrical and electronics segment will be hit and Kaladher says it will be a double whammy for manufacturers, for instance glove producers, who do not have a natural hedge due to high local cost content.

Economic Transformation Programme

Analysts have said the economy will also be a key determinant on how stocks will react in the second half of the year.

ECM Libra Investment Bank Bhd research head Bernard Ching says that with stock valuations for Malaysian equities more expensive than regional peers, analysts will be keeping an eye out on how the economy performs not only for the next six months.

“We are really looking at 2012,” he says.

Economists have in recent weeks downgraded growth projections for Malaysia for 2011 as some have cut their estimates to the lower end of the Government's growth projection of 5% to 6%.

Merrill Lynch (Singapore) Pte Ltd economist Chua Hak Bin feels with the second quarter probably growing by between 4% and 4.5% as global growth slows, the external environment and the sluggish performance of Malaysia's exports would make things tough for the country.

“Achieving 5% is a stretch given the global soft patch. Exports are not going to help,” he says.

One area that might, and the Government and analysts are looking at, compensate for the slower external growth is the economic transformation programme (ETP).

Credit Suisse analyst Stephen Hagger feels the ETP will succeed where others have failed due to its structure, which is private sector driven.

“We believe Malaysia is entering a super cycle' of investment and growth that could result in 6% to 7% per annum. GDP growth for three years, due to the ETP, investment from Singapore, looming general election and cash flow from commodities notably palm oil and rubber,” he says in a note.

Kaladher says the ETP and other transformational programmes undertaken by the Government would offer protection for the stock market in the second half.

“In a way the market has shown resilience in the last six months when most regional indices tumbled towards their March low,” he says.

“The Government's ETP commitment provides some sort of visibility for domestic projects that are expected to cushion the external slowdown.”

In a report on June 13, Credit Suisse says 50% of the ETP projects have taken off. The cumulative ETP-related investments total RM170.3bil.

Zulkifli too agrees on the influence of the ETP and the Government Transformation Programme (GTP), saying those programmes were already in the process of taking the country to the next level.

“Despite all the challenges, the government has managed to institute pro-active programmes to move the country forward, and it is now a matter of execution,” he says.

Apart from the ETP acting as a buffer for sentiment, there are other factors that can act as stabilisers for the stock market in the second half.

“The weightage of banking stocks on the KLCI alone is about 34%, and Malaysian banks are among the best capitalised in the region. Add that by another 16% weightage on plantation stocks and 7% on power stocks, one will get a better appreciation of the defensive nature of the FBM KLCI,” says Zulkifli.

“But from a global perspective, the strongest protection accorded to the FBM KLCI is probably the strength of the ringgit, which we expect to hit RM2.95 to US$1 sometime in the second half. The fundamentals of the ringgit are stronger than that for the US dollar, and that is important for the dollar carry trade.”

Source/转贴/Extract/Excerpts: The Star Online

Publish date:02/07/11

Saturday July 2, 2011

What next for the market?

By JAGDEV SINGH SIDHU

jagdev@thestar.com.my

IT'S one thing to worry about all the noise over the economic developments that envelop global markets and quite another to predict how investors will react to them. But there is one overriding common theme caution.

There are many reasons for such apprehension. The year started with the Arab revolution, which led to the political upheaval in many countries in the Middle East and North Africa. Then there were the earthquake and tsunami in Japan that wreaked havoc on the northeastern coast of the country and had repercussions elsewhere given the deep linkages Japanese industries have in the global supply chain.

If they were not enough to ignite worry among investors, the ongoing debt problems in Europe seems to be frothing over as Greece was on the verge of a massive default that would have caused a severe contagion in lenders from Germany and France, two of the EU's largest economies.

In addition, the economic malaise in US persists. At best, the economic indicators are still patchy to suggest that the United States has truly broken away from the gravity of its financial crisis. To infuse more momentum into the US economy, given fears of deflation, the US Federal Reserve embarked on a second round of printing money, called Quantitative Easing 2 (QE2) to the tune of US$600bil. While the move has injected money into the system and helped lift Wall Street, it really has done little for Main Street.

As a consequence of liquidity and growth rates rebounding in emerging markets, commodity prices have surged, lifting inflation and causing another headache for central bankers, governments and consumers world over given the rising cost of living.

The pain is not spread out evenly across all markets.

The FTSE Bursa Malaysia KLCI this week hit a new record high at 1,582.94 on Friday, the third consecutive day it breach record levels. Maybe it reflected the relief over the austerity measures in Greece's bailout plan which were passed amidst tough internal resistance. This lends credence to the long-held belief that when things get tough globally, foreign investors began to appreciate Malaysia's defensive qualities.

With the close of the first half of 2011, pundits are now poring over how the markets will fare in the second half. Given the volatility of markets and the unpredictability of ensuing events, most of them are likely to adopt cautious projections.

Global Fund Manager Survey

One guide to what people who manage money are thinking about is the Bank of America Merrill Lynch fund manager global survey. The latest published survey, which was conducted from June 3-9 on 282 people who managed US$828bil of assets under management, is pointing to money managers favouring less risk.

The survey's risk and liquidity indicator fell to 38, which is below the long-run average of 40 for the first time in nine months.

“The indicator had been relatively resilient so far despite growth concerns,” says the report.

“Equities and commodities weights have been cut with gains for cash and bonds with most of the asset classes very close to their long-run averages.”

The survey discovered that growth and profit expectations stabilised after recent sharp falls as inflation expectations fell dramatically in June from a couple of months ago.

The fund managers felt the global macroeconomic backdrop was not weak enough to warrant more stimulus as three quarters of its panellists thought a recession was unlikely and only 13% expect a new round of QE in the second half.

Despite concerns permeating investment decisions, emerging markets remain the favoured destination among those surveyed.

Although the numbers have slipped from May where 29% of fund managers polled were overweight on emerging markets, the survey revealed that 23% were positive of the prospects of emerging markets in June.

“The cut in emerging market positions comes amid a broad-based rotation towards defensive assets: Global equity allocations are reduced and the average cash level has risen from 3.9% to 4.2%,” says the report.

Investors were favouring markets with domestic demand drivers and as global economic growth is forecast to drop a tad, investors trimmed their positions in cyclical stocks.

Among the most favoured emerging markets are Russia, Indonesia and China.

One painful finding of the survey is this among the emerging markets, Malaysia was the least favoured. But not all equity research houses may concur with that. Goldman Sachs, for one, has an overweight call on Malaysia and given the relative size of the Malaysian market, a handful of such calls would be enough to provide an oomph.

Defying that painful notion further is the fact that Bursa Malaysia hit an all-time high this week. Furthermore, the trading patterns in April and May show that foreign institutional investors were net buyers of Malaysian equities, quite the reverse from their net selling position earlier in February and March. As for domestic institutional investors, the trend was the opposite they were net sellers in April and May but net buyers over the previous two months.

Trading value which stood at RM52bil in January this year is trending downwards towards May which was the lowest for the year at RM31.2bil. Trading volume has also been falling on a monthly basis since January from 39.5 billion units to 18.4 billion units in May.

Largely, local retailers were net sellers for most of the year, only buying more shares than they sold in February.

Crystal ball gazing

What's next for Bursa Malaysia? Given that the exchange is at record levels, pessimism and optimism seem to be locked in a tug-of-war.

MIDF Amanah Investment Bank Bhd senior vice-president and head of research Zulkifli Hamzah says the first half performance was surprisingly resilient which largely bucked the regional trend.

“On closer observation, we would attribute the resilience of the market to foreign buying,” he tells StarBizWeek.

“Foreign investors were net buyers on Bursa Malaysia in 10 of the 13 weeks between March 21 and June 19. We will not be surprised if foreign shareholding on Bursa Malaysia is higher than 22% now, as an estimated RM4.6bil of foreign money had been ploughed into local equity during that period.”

Zulkifli opines that the foreign money flowing into Malaysia involves genuine portfolio funds instead of speculative money seeking quick returns.

“The upgrade of Malaysia's country status from Emerging to Advanced Emerging market by FTSE effective June partly explain the inflow of foreign money, but more importantly, we believe Malaysia is back on the radar screen of many global funds. This augurs well for the market in the second half,” he says.

TA Securities head of research Kaladher Govindan says many of the worries investors had in the first half appear to be winding down and sentiment wise, the second half should be better.

He feels the concerted effort by the EU to tackle the debt crisis in Europe and Japan picking itself out of a recession should help improve market sentiment and anticipates the second half of the year to be a recovery period after a long consolidation period.

“Slower than expected growth in the United States and lingering sovereign debt issues in the US and Europe respectively are expected to drive back funds flow into emerging markets, which will benefit FBM KLCI,” he says.

Zulkifli is maintaining his year end FBM KLCI target of 1,650 points but expects more volatility in the second half.

“The second half is generally wrought with downside surprises, and is also associated with major market corrections. We do not expect the perception to be any different this year,” he says.

Earnings season will be the focus in August and he feels the numbers for the second quarter is expected to remain bad for airlines, shipping, resource-based industries such as gloves, steel and semiconductor.

“If there are any silver linings at all, we expect Malaysia and other resource-rich countries in this region such as Indonesia and Thailand to benefit from the switch out of China and the Asian tigers,” he says.

“China is engineering a slowdown at a scale not seen by an economic super-power. The statutory reserve ratio for its banks is now at a disconcerting 21.5%. More banks will feel the squeeze.”

Citigroup in its note on Malaysia says the upcoming earnings season in August will likely not excite the market.

“The conclusion of the latest results season confirms our view that overall business sentiment appears to have turned cautious as inflationary threat looms with economic activities on low gear,” it says.

Citigroup feels inflation pressure for food and building materials, together with monetary tightening and higher inflation expectations from the electricity price hike could be negative in disposable income and business profitability. It is positive on chemical and consumer stocks and recommends investors take defensive positions in utilities and gaming.

Sectors to watch out for going forward are the oil and gas, plantation and banking, which recorded higher year-on-year earnings growth during the recent quarterly reporting season.

“We expect their positive earnings momentum to continue into the second half of this year,” he says.

His choice of oil and gas stocks is due to higher oil prices which will not only benefit oil majors but also fabricators as well as support service providers as it encourages further upstream and downstream activities.

“Despite the recent sell down, we expect CPO price to remain firm as the global demand for vegetable oils is rather inelastic,” he says.

He thinks earnings growth for banks will be underpinned by healthy loan growth, enhanced fee-based income, lesser provision with improved asset qualities and the rising overnight policy rate (OPR) which cushioned the pressure on margin.

Apart from these sectors, Kaladher is also overweight on construction.

“Players in the domestic-oriented sectors will do well on the back a stronger ringgit and weaker dollar,” he says.

Inflationary environment bodes well for property sector as well as investors switch from holding cash to real estates.”

Exporters that rely heavily on dollar based sales like those in the electrical and electronics segment will be hit and Kaladher says it will be a double whammy for manufacturers, for instance glove producers, who do not have a natural hedge due to high local cost content.

Economic Transformation Programme

Analysts have said the economy will also be a key determinant on how stocks will react in the second half of the year.

ECM Libra Investment Bank Bhd research head Bernard Ching says that with stock valuations for Malaysian equities more expensive than regional peers, analysts will be keeping an eye out on how the economy performs not only for the next six months.

“We are really looking at 2012,” he says.

Economists have in recent weeks downgraded growth projections for Malaysia for 2011 as some have cut their estimates to the lower end of the Government's growth projection of 5% to 6%.

Merrill Lynch (Singapore) Pte Ltd economist Chua Hak Bin feels with the second quarter probably growing by between 4% and 4.5% as global growth slows, the external environment and the sluggish performance of Malaysia's exports would make things tough for the country.

“Achieving 5% is a stretch given the global soft patch. Exports are not going to help,” he says.

One area that might, and the Government and analysts are looking at, compensate for the slower external growth is the economic transformation programme (ETP).

Credit Suisse analyst Stephen Hagger feels the ETP will succeed where others have failed due to its structure, which is private sector driven.

“We believe Malaysia is entering a super cycle' of investment and growth that could result in 6% to 7% per annum. GDP growth for three years, due to the ETP, investment from Singapore, looming general election and cash flow from commodities notably palm oil and rubber,” he says in a note.

Kaladher says the ETP and other transformational programmes undertaken by the Government would offer protection for the stock market in the second half.

“In a way the market has shown resilience in the last six months when most regional indices tumbled towards their March low,” he says.

“The Government's ETP commitment provides some sort of visibility for domestic projects that are expected to cushion the external slowdown.”

In a report on June 13, Credit Suisse says 50% of the ETP projects have taken off. The cumulative ETP-related investments total RM170.3bil.

Zulkifli too agrees on the influence of the ETP and the Government Transformation Programme (GTP), saying those programmes were already in the process of taking the country to the next level.

“Despite all the challenges, the government has managed to institute pro-active programmes to move the country forward, and it is now a matter of execution,” he says.

Apart from the ETP acting as a buffer for sentiment, there are other factors that can act as stabilisers for the stock market in the second half.

“The weightage of banking stocks on the KLCI alone is about 34%, and Malaysian banks are among the best capitalised in the region. Add that by another 16% weightage on plantation stocks and 7% on power stocks, one will get a better appreciation of the defensive nature of the FBM KLCI,” says Zulkifli.

“But from a global perspective, the strongest protection accorded to the FBM KLCI is probably the strength of the ringgit, which we expect to hit RM2.95 to US$1 sometime in the second half. The fundamentals of the ringgit are stronger than that for the US dollar, and that is important for the dollar carry trade.”

Source/转贴/Extract/Excerpts: The Star Online

Publish date:02/07/11

Saturday, 2 July 2011

Bullish on China for the long-term?

January 25, 2011 by financiallyfreenow

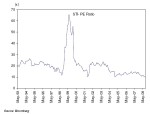

Many investors are bullish on the prospects of China’s growth going forward. I belong to this camp too. I’m extremely bullish on China as an emerging market. There are several reasons for this.Firstly, the Shanghai SSE 50 A-Shares Index is currently trading at a P/E of 13.33. Valuations peaked at around 70 times earnings in 2007. At current levels, the Chinese equity market is extremely undervalued, considering that China is one of the fastest growing economies in the world. Also, less than 10% of the Chinese households are invested in the stock market, according to the Edge magazine. In developed countries, the percentage is between 40-60%. As China develops, the participation in the stock market will grow as well.

Secondly, the 12th five-year plan will be revealed later this year. Investments into fixed assets should be strong in the first year or two as it will beneficial for government agencies and corporations to launch new projects to secure the respective resource allocations.

Thirdly, with the US losing steam and foreign funds flowing into China, the next phase of growth will be in China. China has shown it is capable and is able to stand up to the big boys with the concluded World Expo, Olympics and Asian Games. Consumerism will boom, tourism will rise and the service sector will certainly climb up. China cannot stay as an exporter for long. They have been working hard making cheap stuff and it will be time that they taste the fruits of their labour. China may become a nation of consumers but not so soon. Also, the Chinese government has so much cash in its coffers vs the trillions of dollars of debt US owes.

On the other hand, inflation is rising and the government is battling hard to keep inflation under control. Interest rates have risen recently to battle inflation. However, the dust will settle eventually and investors will flood back into the market once everything cools down. If you have a long-term view (i.e. >10 to 20 years), this inflation scare is very minute as compared to the growth that China will see.

To capitalise on the boom of China and invest in A-Shares that only local Chinese can, one can purchase the “United SSE 50 China ETF” listed on SGX. Extracted from shareinvestor.com: “The ETF tracks the SSE 50 Index. The SSE 50 Index is an index consisting of 50 constituent stocks which are the 50 largest stocks of good liquidity listed on the SSE. The United SSE 50 China ETF is the first China A-Share ETF to be listed on the Singapore Stock Exchange. It is also the first China A-shares ETF to be denominated and traded in Singapore Dollars.”

Disclaimer: This post does not serve as a recommendation to buy the United SSE 50 China ETF. Before investing in the ETF, it is paramount to read the prospectus carefully. Risks include tracking error, counter-party risks, among others.

Putting P/E ratio into perspective

December 26, 2010 by financiallyfreenow

A company with low P/E ratio may not mean that it is attractive (or undervalued) due to the following reasons:

- company has uncertainty over its prospects for earnings

- company is operating in a highly cyclical sector

- company is serving volatile markets

- company is operating in a sector with overcapacity and weak pricing power

- company is operating in a sector with low returns consistently

- company operating in a mature sector, with little prospect for growth

- company is ex growth

- company has poor management with no convincing strategy for growth

- company has poor cash generation

- company has a weak balance sheet

- company has an excellent growth record and prospects for growth

- company is operating in a high-growth sector

- there’s high confidence in company’s forecasts

- predictable/stable returns

- strong market share

- high barriers to entry

- strong pricing power

- high margins and excellent returns

- superior management with excellent growth strategies in place

- strong cash generation

- strong balance sheet

Advantages of P/E ratio:

- easy to compute

- widely used so it’s easy to find a company’s P/E ratio

- takes forecasts into account

- earnings is a measure of what is generated for shareholders

- does not take debt/financial structure of company into account

- gearing up/share buy-backs increase earnings (‘financial engineering’)

- earnings are prone to manipulation by management

- does not take cash generation into account

- presents difficulties in assessing quality of earnings

Book Review – How an Economy Grows and Why It Crashes

September 19, 2010 by financiallyfreenow

I recently completed reading a book called “How an Economy Grows and Why It Crashes” by Peter Schiff and Andrew Schiff after reading rave reviews from Amazon.com. This book teaches on how the economy works, why it prospers, why it crashes, among others. Even though this book is centered around the US economy, you can still learn a lot from this book. I thoroughly enjoyed reading this book as it has comic sketches as well. The book is so simple to understand yet the topics covered have depth. I have no economic background from school so this book makes it easy to learn about the economy.

This book espouses the Austrian School instead of Keynesian economics embraced by most politicians and economists nowadays.

To summarise this book:

- Economies grow by finding better ways of producing more stuff that humans want. This doesn’t change, no matter how big an economy grows into.

- A government’s increasing debt take-up has hidden the fact that real credit is limited by a finite supply of savings. Savings must be accumulated before it can be lent out.

- Savings create the capital that allows for expansion of production. A dollar saved makes a more positive economic impact than a dollar spent. If there is real demand, what is produced will be bought without needing artificial demand.

- Artificially expensive currency, high taxes and restrictive wage and labour laws makes US not as competitive in enough products ranges as compared to China. So, what if China can produce cheaper goods? Isn’t that good for US as its citizens can buy cheaper products?

- Recession is good as it re-balances the economy.

- US gets stuff without producing them and get to borrow money without having to save. For that, the Chinese get to work without consuming what they produce. They save but don’t get to borrow. Where’s the benefit there?

- US is simply fortunate to sell its debt to foreigners. But the “good fortune” can’t last forever. The US is gravely in debt in the tune of $13 trillion and it surely cannot pay up most of it. The US government is literally bankrupt! If it was a public-listed company, it would have gone bust long time ago. Now, the US has only two options: default (tell the creditors that it can’t pay up) or inflate (print money to pay off maturing debt). Either options leads to painful consequences. However, defaulting is the better option as it offers a fresh beginning.

- With over 50% of the government debt currently sold to foreigners, who will pick up the sack when the foreigners stop buying? With little domestic savings, Americans alone will not be able to do it.

After reading this book, I have decided to shift my portfolio around after the warnings from the book. I had holdings in US stocks like SPY which were meant to be long-term investments. After reading this book, I decided to sell my holdings off and withdraw my US dollars from the broker. I’ve decided to invest them in a China ETF dominated in Singapore dollars and listed in SGX. I feel this is a much safer for me as I’m a very conservative investor. Some might say that I’m just too paranoid and that US will still retain its reserve status no matter what happens. However, I’m not taking any chances, at least for the next 20 years. I will just wait and see what actually happens and learn from it. I’ve more confidence in the Singapore and Asian markets than the US market.

The book covers much more than what was summarised on top. I just summarised from the book the main points to show why I chose to sell off my US holdings and convert the US dollars to SGD.

Anyway, two things still perplex me when it comes to the workings of China. Why must China “heed” US’s request to appreciate the yuan? Also, why does China still buy US debt when China’s economists should have understood long time back that US bonds are not worthy of holding? Hopefully, someone can enlighten me on these two issues that has been nagging me for some time.

(On a side note, MPH Raffles City is having 30% off on regular-priced items till end of the month. So, go grab this book if you want a simplistic yet deep understanding of how an economy works and why it crashes!)

P/E ratio of STI

December 18, 2010 by financiallyfreenow

Warren Buffett Interview – 2nd March 2011

March 7, 2011 by financiallyfreenow

I would post some of the questions and answers of the topics that I found interesting below.

On the US economy

BECKY: Your annual shareholders letter that you just came out with on Saturday painted a much more optimistic picture of America than many people had been thinking to this point. Why is that? And why are you so positive about things?

BUFFETT: Well, I’ve been optimistic on America right along, as you know. I mean, I was optimistic when I knew things were going to go to hell. But things do – America gets off the track from time to time, and it was particularly so in the fall of 2008. But you can’t stop this country. I mean, we have gone through, I don’t know, 15 recessions, you know, world wars, civil war, you name it. And there is a resiliency to the American system. It does work. And it sputters from time to time. It’ll sputter from time to time in the future, but you don’t want to get too concerned about that. It’s kind of like having a bad crop in farming. If you’ve got some good land here in the Midwest, you’re going to have a bad crop occasionally. But you know you’re going to have mostly good crops and we have great soil for this country, metaphorically. And it works over time

On gold and commodities

BECKY: Well, speaking of gold, though, we’re looking at gold prices and they were at another record high. They’re up another $3 today, $1,434 an ounce. And there have been some big fat hedge fund managers, like a Paulson or a David Einhorn, who have really buckled down on these bids. Why would you steer clear? And do you think what they’re doing is the wrong thing?

BUFFETT: Well, I just don’t know. I don’t know whether cotton’s going to go up.

BECKY: OK.

BUFFETT: I mean, we use a lot of cotton. I’ve watched it go from 80 cents to $1.90. You know, we use a lot of copper and I’ve watched it go from $2 to $4-plus, so I mean there’s all kinds of things in this world that are going to go up and down in price. You know, maybe hamburgers will tomorrow. And – but I – I’m – I don’t know how to judge that. I do know how to judge to some extent the earning power of some businesses. And the real test of whether you would like it as an investment is whether you would be happy if it never got quoted again, and just in terms of what the asset did for you. But that doesn’t – I will say this about gold, if you took all of the gold in the world it would roughly make a cube 67 feet on a side. So if you took all the gold in the world, we could have a cube that went down there 67 feet…

BECKY: Uh-huh.

BUFFETT: …67 feet high and that would be the whole thing. Now for that same cube of gold it would be worth at today’s market prices about $7 trillion. That’s probably about a third of the value of all the stocks in the United States. So you could have a choice of owning a third of all the stocks in the United States or you could have a choice of owning that little block of gold, which can’t do anything but kind of shine there and make you feel like Midas or Croesus or something of the sort. Now, for $7 trillion, there are roughly a billion of farm – acres of farmland in the United States. They’re valued at about $2 1/2 trillion. It’s about half the continental United States, this farmland. You could have all the farmland in the United States, you could have about seven Exxon Mobiles, and you could have $1 trillion of walking around money. And if you offered me the choice of looking at some 67-foot cube of gold and looking at it all day, you know, I mean touching it and fondling it occasionally, you know, and then saying, you know, `Do something for me,’ and it says, `I don’t do anything. I just stand here and look pretty.’ And the alternative to that was to have all the farmland of the country, everything, cotton, corn, soybeans, seven Exxon Mobiles. Just think of that. Add$1 trillion of walking around money. I, you know, maybe call me crazy but I’ll take the farmland and the Exxon Mobiles.

On the US dollar depreciating

JOE: …because, yeah, let’s just wait and I’ll ask him a follow-up to. Because you do get paid back with your investments in dollars. And if those dollars are, you know, are going to be worth much less in the future then I figure you must – you must figure policymakers are going to get it together eventually, Warren, or else, you know, paper money’s not going to be worth anything.

BUFFETT: Well, but that’s true of – if you’re – if you’re trained to be a lawyer or you’re trained to be on cable or anything else you’re going to get paid in dollars. Now, the question is, if you have something valuable to offer even if the dollar gets worth less, you will retain earning power that’s commensurate with purchasing power.

JOE: Ooh.

BUFFETT: And if – I mean, Coca-Cola, the – in the year since I’ve – was born the dollar has depreciated 94 percent. I mean, it’s 16-for-1 in terms of inflation. But if you owned Coca-Cola in 1930, you’ve still done pretty well. Or if you owned a lot of good business in 1930. Because they have the ability to extract real earnings in terms of what they deliver to people. And your doctor is able to charge 16 times as much as in 1930 because his services are still as valuable. So, as the currency gets worth less, it does not make – it does not penalize the service or the good that is really needed by other people. The world adapts.

JOE: Hmm.

BUFFETT: And that’s why I like businesses or I like my own earning power as the best assets in a time of inflation. They really can’t be taken away.

On why he likes private businesses compared to public business

BECKY: All right, the first one, let’s say, comes in from Miykael in Canada, who writes in, “With articles mentioning that you’re looking for major acquisitions, with the economy favoring the low-cost segment, wouldn’t Family Dollar be an ideal fit?”

BUFFETT: Well, there are a lot of companies that would be a fit at a price. It’s easier for us to buy businesses that are privately owned than ones that are trading on the market because people – I don’t care what the market price is in terms of what they’re worth to us. But generally speaking, people, in evaluating mergers and acquisitions, look at the premium pay to the market price and decide whether that’s a fair price or not. A fair price to us is one that – where we think we’re going to get our money’s worth in terms of future earnings, and I would say that we will generally have more luck with private businesses than public businesses, although Burlington was a public company, yeah.

On why businessmen should keep their private businesses

BUFFETT: Well, Mars is a wonderful business, and we’re their partners in Wrigley. And if the Mars family were to ask me about selling their business, I would say keep it.

BECKY: Mm-hmm.

BUFFETT: I mean, if you own a wonderful business in life, the best thing to do is keep it. All you’re going to do is trade your wonderful business for a whole bunch of cash, which isn’t as good as the business, and now you got the problem of investing in other businesses, and you probably paid a tax in between. So my advice to anybody who owns a wonderful business is keep it. Now, sometimes there’s a – some reason in terms of taxes or family situations or whatever it may be that a wonderful business is for sale. But I have told a number of people who’ve come to me who have wonderful businesses, if you can figure out a way to keep it, keep it, because all you’re going to do is take that billion dollars you get, or 5 billion, you’re going to pay some tax on it, now you’re going to go out and buy some stocks, and most of those stocks you buy are not as wonderful as the business that you already owned, and you don’t know as much about it and, you know, so sometimes it pays to know when you’re well off.

On liquidity and savings

BECKY: Yeah, you wrote about that in the annual letter, as well, and said that the thing that you learned coming out of that is the importance of liquidity and not getting over leveraged.

BUFFETT: Yeah. My grandfather left–gave $1,000 eventually, at 10 years after the marriage of each of his children and my aunt didn’t marry, but he gave her $1,000 as well and he sent them this letter and he said, `Put this money away.’ He said, `Don’t get tempted to invest it because some day you may need money and who knows what you’re can do with your investment then.’ So you’ll always want to have some cash. He gave me a $2 bill when I was a kid and he said carry this around and he said you’ll, you know, you’ll never be broke.

Buy stocks like a businessman

May 27, 2011 by financiallyfreenow

Investing in a company’s stocks is the same as buying the business. Even if we are buying with a small percentage of our capital, we should research thoroughly into the company and value it as if we are buying the whole company. We should also buy the stocks with a mindset that it will feed our family for the rest of our lives (our livelihood depends on this particular purchase). If we do so, we will invest prudently and allocate capital wisely – like a prudent businessman.Let’s say you are interested in Raffles Medical and let’s imagine that this is not a listed company. All the qualitative and quantitative criteria are met and we want to purchase it. How do we know how much to pay to purchase the whole business? We would need to look at the financial statements especially the cash flow statements and come up with an intrinsic value of the business. Intrinsic value is the summation of the future cash flow discounted to the present value. With this figure, we would know how much the business is worth and how much we have to pay for it. Now, since Raffles Medical is a listed company, we can check out the current trading price from the SGX website. We can then compare the current price to the intrinsic value of the business. If the intrinsic value is much higher than the current price with a huge margin of safety, we can safely buy into Raffles Medical. This is how to approach buying a stock from the business perspective. Calculating and knowing the intrinsic value of the business we are buying into also allows our emotions to be in check.

On the other hand, purchasing a stock by looking at the 52-week high or low is not the right way to approach stock investing. The 52-week high or low says nothing about the intrinsic value of the business. Stock market is like a voting machine in the short-term and stock prices fluctuate up and down depending on emotions of the traders. Like Benjamin Graham said, purchasing a stock should be business-like and approaching investing from a businessman perspective indicates prudence. Once we have purchased the stock, we must imagine that the stock market has closed down for the next 10 years and not check the prices regularly. It takes time for a business to grow and prosper and the stock price to be indicative of the intrinsic value of the business.

In summary, when investing, always approach investing from a businessman’s perspective and think like a businessman “How much will it cost me to purchase the whole business?”. Also, be in the mindset that your purchase will feed your family for the rest of your life, so there are no chances for error.

Psychology of Great Value Investors

May 22, 2011 by financiallyfreenow

1. Be disciplined- Successful investors are very disciplined and they do not let emotions (eg. fear and greed) get in the way. They buy and sell on strict rules. Using a checklist on when to buy and when to sell will help to curb out the emotions and make us detached from our stock holdings.

- Warren Buffett’s famous quote, “Be fearful when others are greedy and be greedy when others are fearful” rings true. When the whole world is shouting “Buy!” and stock market is going up on a frenzy, you should be fearful and even look to sell some of your overvalued stocks. A market crash or recession, when the majority are fearful, is a good time to consider buying assets at selling at unbelievable discounts.

3. Never rely on experts. Be an expert yourself.

- Never rely on experts or gurus as they are humans themselves, they do make mistakes and they can be wrong at times too. Have an independent thinking and research into companies yourself instead of relying on analysts or brokers. You won’t know what hidden agenda the guru or analyst might have in releasing a buy call on a certain stock. You can always read an analyst report, digest their materials and conduct your own intimate research into the stock you are interested in.

4. Invest only when there’s minimal risk.

- Before investing, always think “What’s my downside?” or “How much am I willing to lose?”. Remember Warren Buffett’s rules “Rule No.1: Never lose money; Rule No.2: Don’t forget Rule No.1″. Always think in terms of preserving capital before thinking about making money.

5. When there’s nothing to invest in, don’t invest!

- When the world stock market is in a bubble and market P/Es are hitting the roof like during the dot-com bubble, sit tight in cash and just enjoy the world go past.

6. Take responsibility of your own mistakes and never blame others.

- When you make a wrong investment, think through what went wrong and do a post-mortem. This will help you to make an informed choice in the future and ensure that you will not repeat the same mistakes again. When you blame others for your mistakes, you will be bound to make the same mistakes again and you won’t be a better investor. There are no failures, only feedbacks.

7. Don’t time the market. Take action with what is presented before you.

- Timing the market is futile. Take action as and when the market presents itself before you. There are many researches conducted on timing the market and all point to the same conclusion: Time in the market is more important than timing the market. It doesn’t matter if you are right or wrong. What matters is how much you make when you are right and how much little you lose when you are wrong.

Value investing is BOOORRINNGGG!!!

June 2, 2011 by financiallyfreenow

Value investing is boring! I can hear some of you shouting “HELL YEAH!”. It’s boring because sometimes we need to wait for eons before our investment reaches the intrinsic value. It’s boring because we don’t get instant gratification and prices take a long time to move (I know you are thinking about Kingsmen!). It’s boring because we need to sit still and have to control those itchy hands of ours.Value investors need to have lots of patience and discipline (and I really means LOTS). When we buy into a stock, we should not expect to make money immediately. In fact, we must be mentally prepared to lose paper money in the short-term. It most probably will take a long time for the stock to rise up to the intrinsic value. In the meantime, we need to sit still like good boys and girls and not meddle with our portfolio. The trader in us always wants to do something like sell off when there’s a small profit and cut loss unnecessarily, thinking we can buy back later. We have to control the urge to do that and remember that we are in this for the long-term. If the business fundamentals are intact, we should just sit on the sidelines and not do anything. When the price dips and goes down tremendously, we must have the discipline to not hit the sell button out of panic (provided the business is still flourishing).

Currently, some stocks in my portfolio are down and my China ETF is down 10% as of today due to the negative market. I’m willing to hold on to them as I believe they are undervalued and have lots of room for capital appreciation. I do feel emotional at times when my stocks are down but I need to keep on reminding myself that I’m in this value investing business for the long-term and am not here for short-term gains. Having more patience and discipline is what I need to work on and am working on it constantly. For the short-term, the prices fluctuate up and down but value is what I get for the long-term. Value investing is not easy due to the strict discipline and patience we need to have. This might explain why not many are into value investing. Having said that, those who have control over their emotions will see tremendous benefit for the long-term and I believe in this. Many have been there, done that. People like Benjamin Graham, Warren Buffett and Peter Lynch are/were great value investors due to their emotional control and they have shown us that it can be done with the right skills and attitude.

Actually, contrary to the title, value investing is not boring and I need to confess my love for value investing. I feel value investing is one of the best ways to accumulate wealth. All that is needed is just a bit more of mental fortitude so that we don’t succumb to unwarranted actions that will affect our portfolio.

Subscribe to:

Posts (Atom)