Be decisive, Be patient, Don’t be greedy, Don't be stubborn

Disclaimer

如果要翻译这个网站,请使用google translate http://translate.google.com

The information contained in is provided to you for general information/circulation only and is not intended to nor will it create/induce the creation of any binding legal relations. The information or opinions provided do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should seek advice from a financial adviser regarding the suitability of the investment products mentioned, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to purchase the investment product. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest.

Any views, opinions, references or other statements or facts provided in this are personal views. No liability is accepted for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on the information provided herein.

Personal Data Protection Act (PDPA)

You would like this website to collect your personally identifiable information that can be used to contact or identify you (“Personal Data”). Personal Data may include, but is not limited to:

- Your name, email address and phone number.

You acknowledge and consent to our collection of your personal data for contacting you on the purposes listed below:

- Marketing, advertising and promotional purposes related to the content of this website

- Provision of products & services which you have requested for

Please note that you are entitled to withdraw your consent for the collection of your personal data at any point in time by providing a notification to ckchoy77@gmail.com.

Note:

All TA (Technical Analysis) view using charts are for illustration purpose only.

Unless otherwise specified, all charts' sources are from POEMS(Phillip Online Electronic Mart System)

Tuesday 17 November 2015

Wednesday 11 November 2015

Daniel Loh 11月5日 FM958电台访问:美国股市9月到底部的3大原因!

· 美国股市9月到底部的3大原因

美国昨天闭市在17868点。很高兴的是美国股市这一个月的走势确实按照我们所说的。一个月前和两个星期前,我们都说我们确实看好美国第4季度的股市。

一个月前美国道琼斯指数还在16000点。短短一个月已经涨了1800点。现在离历史高点只差500点了。新加坡海指也从一个月前的2750点涨到了现在3030点。

今天我想提3点为什么我们当时会觉得16000点,9月的时候会是低点。以后大家就可以自己炒作。

(关于我9月和10月说的访谈)

9月10日 FM958电台访问:世界股市有救吗?

10月8日 FM958电台访问:美国股市第4季度会反转吗?

http://www.danielloh.com/2015/10/daniel-loh-108-fm9584.html

第一:

我们还是觉得美国市场还是一个大牛市当中。因为利率还是非常低。只要利率低,熊市就不会来临因为股市跌多了,热钱就会进来。大家不用害怕熊市的来临。也不要相信任何恐慌的说法。

第二:

既然美国还在牛市当中,我发现只要道指跌破200天的移动平均线(200MA),股市在两周内必定见底。如果大家会用图表,可以自己画出200天的均线。这一条线是牛市的生命线。只要跌破这一条线,我发现两周以内大家就一定看到谷底。这一次跌破了,3天就到谷底。两周后,股市刚好就在16000点。因此我们也是因为这一点一个月前跟大家说可以开始看股票了。

第三:

我们也发现,道琼斯指数如果还是一个牛市,最多会跌一个10-15%。这一次跌深了。但是也刚好只跌15%。如果大家拿最高点18351点X0.85 = 15600点。这一次道指跌最深时15400点,当天就反弹了。以后大家记得,只要我们还是牛市,只要道指跌15%,通常都是非常好的机会。

· 新加坡海指3000-3250范围

一个月前,海指从2750点跑了上来。现在是3030点了。虽然已经跑了10%,但是我还是觉得还有往上升的空间。我还是看好道指第4季度的表现。美国会有许多的节日,可能还会带动股市。因此我觉得海指还有望上升。

我判断第4季度,海峡指数可能会在3000-3250点徘徊。3000点就是低点,3250点就是高点。如果到了3250点,大家一定要小心。

我鼓励大家稍微留意一下农务大众商品的股票。我觉得2016年这一类的股票有可能表现会不错。

· 谁说中国股市进入熊市??

我们都一直在节目中强调,中国股市现在在牛市的第二个阶段,不要害怕。我们预测上证指数都会一直在3000-4500点跑动。现在是3450点了。我觉得还是相当便宜的。虽然大家看到中国的经济数据一直很不好,但是股市还是上了。

我鼓励大家留意一些中国房地产的公司。只要利率一直下滑,房地产公司一定获利。

Wednesday 4 November 2015

投资者如何选择一支良好的基础股票? by Daniel Loh (骆伟嵩)

值得长期投资股票- GLP, Singpost, ThaiBev, First Resources.

Wednesday 12 August 2015

Market sense - TA

by ckchoy

AIA HK supports 48.3, 47.6, 46.6

SGX supports 7.38-7.3

Kepcorp immediate support 7.3, if break, then long term support 7.02

Wingtai 1.85 good price

Tencent enter betw 127.2 - 133.5. but if break 127 must cut

Semmarine needs to clear up 3.03 before turn bullish again. expect 2.9 - 2.95 strong resistance

Singtel 3.92 - 3.8 mid term support, can try a bit but expect tight range

Boustead break 1.08 support, next is 1.014, 0.9, this counter tied to gov project like hdb

AIA HK supports 48.3, 47.6, 46.6

SGX supports 7.38-7.3

Kepcorp immediate support 7.3, if break, then long term support 7.02

Wingtai 1.85 good price

Tencent enter betw 127.2 - 133.5. but if break 127 must cut

Semmarine needs to clear up 3.03 before turn bullish again. expect 2.9 - 2.95 strong resistance

Singtel 3.92 - 3.8 mid term support, can try a bit but expect tight range

Boustead break 1.08 support, next is 1.014, 0.9, this counter tied to gov project like hdb

Tuesday 4 August 2015

Thursday 23 July 2015

Attacks on Noble Group’s accounting take their toll

http://www.ft.com/intl/cms/s/0/c8fc2144-2974-11e5-8613-e7aedbb7bdb7.html#axzz3gg90bexA

Asian commodity trader defends its financial reporting amid a review of how it values contracts

s the US shale boom went into overdrive, Asia’s biggest commodity trader was keen to trumpet its involvement.

In its 2013 results, Noble Group highlighted a long-term sales and marketing agreement with the owners of a planned gas-fed petrochemical plant in Texas as one of the highlights of the company’s year. What the Hong Kong-based company did not reveal was that the contract had been quickly pushed through, apparently with the aim of allowing Noble to record a profit in its third-quarter results, several people familiar with the deal said.

How Noble reports profits on this type of long-term commodity deal is now the centre of a fierce battle between the trading house and its critics, led by a previously unknown research group, a famous US shortseller and a former investment banker.This was surprising because construction of the plant had not begun, these people added. Two years later and the project, 40 miles south of Houston, has an environmental permit but its owner, Ascend Materials, said that construction was “under review” due to big changes in the price of gas and oil. Noble has not responded to repeated questions about the contract.

The critics allege the Hong Kong-based company — which acts as a middleman for buyers and sellers of oil, coal, iron ore and metals — is providing a misleading picture of its financial performance. They claim Singapore-listed Noble has pushed the limits of international accounting standards so that it can record profits on long-term deals to source and supply commodities well before the company receives any cash payments.

“The only question management really needs to answer is how much profits have come from long-term contracts from which the group has not received payment,” says Gillem Tulloch of GMT Research, an independent research firm. “It’s a fairly simple question and yet one which it has steadfastly refused to answer.”

Noble has strongly defended its financial reporting. Richard Elman, Noble’s founder and chairman who started out in Britain’s scrap metal trade, has bought shares to demonstrate his confidence in the company. Noble says: “Our accounting is robust, we have a highly experienced board with strong, independently led audit and risk committees, and are supported by our key stakeholders.”

Noble’s critics have not accused the company of illegality, but these attacks have taken their toll. Its shares — partly hurt by the downturn in commodity prices — have fallen more than 40 per cent since February, when Iceberg Research, a small research firm, highlighted how Noble had reported much higher net profits over the past five years than it had generated cash. When profits and cash differ significantly for a protracted period it can be a red flag for analysts because it raises questions about a company’s financial performance.

In aggregate, Noble reported net profits of $2.54bn between 2009 and the first quarter of 2015, yet net cash flows from operating activities amounted to just $118m over the same period.

Iceberg alleged the main reason for this divergence was Noble overstating the value of some of its commodity deals — it has more than 12,000 contracts in total. In April Muddy Waters, the US short seller, also criticised Noble’s accounting.

Last month Standard & Poor’s, the rating agency, warned Noble its investment grade credit rating, which is crucial to its operations, could be downgraded to junk status without greater transparency. It expressed concern at the mismatch between Noble’s reported profits and cash generation on its long-term commodity contracts.

A typical long-term purchase and supply agreement involving Noble might look like this. The company agrees to buy coal from an Indonesian mine for 10 years at a 3 per cent discount to the market price. It then strikes a deal to sell the coal to a Chinese power station at a 2 per cent premium to the market price. After subtracting shipping and other costs, Noble should then make money on the agreement.

In order to book profits on these long-term commodity deals, Noble relies on its own mark to market models to place a value on the contracts. The fair value of these contracts are estimated on an ongoing basis, enabling gains to be recorded on Noble’s balance sheet.

Other commodity traders engage in similar practices, but Noble stands out from rivals for the sheer scale of fair value gains being reported in recent years. At March 31, Noble said net gains on its commodity contracts amounted to $4.1bn, or more than 80 per cent of the company’s shareholder equity. At the end of last year, such gains amounted to 90 per cent of Noble’s shareholder equity, compared with 0.2 per cent at Glencore and 3.8 per cent at Trafigura, according to UBS analysts.

The biggest fear among analysts is that some of Noble’s valuations for the long-term commodity deals could be unrealistically large, and that the amount of cash eventually received for the contracts will be far lower than the profits it has previously recorded.

“What we would like to see is a record of how some of these long-term contracts run off and the cash realisation of the portfolio,” says Christopher Lee, a managing director at S&P.

At the same time, Noble’s accounting for its investments in other companies has come under scrutiny.

Noble has a 13 per cent stake in a listed Australian miner called Yancoal. The company currently has a market value of $95m, making Noble’s investment worth around $12m. However, in its 2014 annual report, Noble recorded the “carrying value” of its Yancoal stake at $322m.

Noble defended the valuation of lossmaking Yancoal last month. In an open letter addressed to a vocal critic of the company, a former Morgan Stanley banker called Michael Dee who has called for Mr Elman’s resignation, Noble said that just because Yancoal “currently loses money . . . this does not mean it will always lose money”.

More broadly, Noble has dismissed Iceberg’s attacks as the work of a former employee it believes is disgruntled — a credit analyst called Arnaud Vagner. He was fired in 2013, and is being sued by the company in Hong Kong. Iceberg would not comment on whether Mr Vagner works at the firm.

But Noble has responded to concerns expressed by some analysts.

Yusuf Alireza, the former Goldman Sachs banker appointed Noble chief executive in 2012, promised in March to deliver greater transparency around the company’s financial reporting.

In the most significant move so far, Noble announced this month it was hiring PwC, the accounting firm, to review its “[mark to market] models, valuations, and governance framework”, saying a summary of the work would be published in due course.

Singapore’s stock market regulator said the PwC review would “address and help bring closure to questions raised by the market”.

Not everyone is convinced. Iceberg, in its latest report on Noble this week, said PwC would not answer the question “does Noble violate the spirit of the law” through its valuations of commodity contracts.

Noble said the PwC review, overseen by a board committee, would offer further transparency to the market. “We look forward to the review’s findings,” it added.

The company declined requests for an interview with Mr Alireza, and also did not answer questions about the contract regarding the Texas petrochemical plant that has yet to be built.

On the southern flank of Mongolia’s windswept Gobi desert sits an undeveloped coal mine, whose value, Noble Group said, has jumped 17-fold in almost as many months.

In February last year, Noble bought the 50,000-acre Enkhtunkh Orchlon mining prospect for $3.76m. Last month, it sold it to Australia’s Guildford Coal for “up to $65m”.

Some analysts and hedge funds have questioned how the value of the mine has increased so much in such a short space of time, and whether Noble has overstated what it might eventually receive from the sale.

So far, Noble has been paid $6m in cash by Guildford for the mine, according to people familiar with the deal. The majority of the headline $65m sale price reported by Noble is now dependent on future royalty payments by Guildford to the Hong Kong-based trader, from a mine that is yet to start producing coal.

Company filings by Sydney-listed Guildford show it is heavily reliant on Noble. Guildford’s auditors, Ernst & Young, said in the company’s 2014 accounts that without Noble the miner may cease to be a viable going concern.

“Guildford is financially dependent on Noble,” said one hedge fund manager. “[It is] akin to vendor-financing. Let’s see if [Noble] can collect its loans from the buyer.”

Guildford, which declined to comment, has already used at least $32m of borrowed cash from Noble to develop a Mongolian coal mine close to Enkhtunkh Orchlon.

Noble said the sharp increase in Enkhtunkh Orchlon’s value was justified by a recent assessment of its coal reserves.

In its filing announcing the mine sale to Guildford, Noble said it was agreed on a “willing-buyer, willing-seller basis”. It aims to establish a long-term sales and marketing agreement for the coal if Guildford can successfully develop the mine.

|

Tuesday 21 July 2015

Retail investors trying to get hold of shares in new Catalist listings iX Biopharma, NauticAWT and Choo Chiang Holdings may have a tough time.

Three latest Catalist aspirants opt for safety of placements

By Jeffrey Tan and Joan Ng / theedgemarkets.com | July 16, 2015 : 7:21 PM MYT

Share on facebook Share on twitter

Printer-friendly versionSend by emailPDF version

SINGAPORE (July 16): Retail investors trying to get hold of shares in new Catalist listings iX Biopharma, NauticAWT and Choo Chiang Holdings may have a tough time.

Each of the three companies are offering a mere one million shares for public application, with the rest of their issues being placed out through their respective agents.

iX Biopharma, an Australia-based pharmaceuticals company, is issuing 65.5 million shares at 46 cents each to raise $30.1 million.

Choo Chiang, a distributor of electrical products and accessories, is issuing 32.3 million shares at 35 cents each to raise $11.6 million.

NauticAWT, which provides engineering services to the oil and gas industry, is issuing 28 million shares at 20 cents each to raise $5.6 million.

“Why list the company in the first place?” says S. Nallakaruppan, an investment specialist with a local brokerage firm, via e-mail. “It is supposed to be an ‘initial public offer’ and not an ‘initial private offer’.”

Nallakaruppan argues that not only does the lack of public availability limit public participation in the stock market, it also creates a “conducive environment for price manipulation”.

In January, Nallakaruppan was among the local trading representatives who banded together to pen a letter to Deputy Prime Minister and Finance Minister Tharman Shanmugaratnam deploring the state of the local market.

Among their grouses: initial share sales with few or no shares issued to the public. The 1,225 individuals who signed the letter proposed that listing rules should require at least 25% of shares to be issued to the public.

Companies that come to market aren’t currently required to offer shares for public application, which is typically done through bank ATMs. In April, GCCP Resources came to market purely with a placement.

Bankers and brokers say distributing a high proportion of IPO shares to individual investors via ATMs can be risky, especially when the market is volatile and investor sentiment is weak.

Traders say that interest in the current issues has been relatively weak.

CIMB ( Financial Dashboard), the issue manager for iX Biopharma’s and Choo Chiang’s IPO, says it typically advises its clients to have at least one million shares made available to the public.

“At least people may apply at the ATM and that could raise awareness for the IPO, which would be good for the company,” says Yee Chiah Sing, CIMB’s head of Catalist.

Yee says it is challenging to gauge the potential demand for the ATM tranche, which makes it a “balancing act” in the end.

“We don't know if the public will apply. But with our existing customers, we know them and we can gauge the demand,” he says.

“A 25% allocation for the ATM tranche may be on the high side. It is tough to gauge retail sentiment and we may end up with a shortfall. This would not be fair to our clients too, who may be interested in the shares,” he adds.

Alex Tan, CEO of Canaccord Genuity, the issue manager for NauticAWT’s IPO, says the offer tranche of one million shares contributes to about 3.6% of the total invitation shares, which is “largely in line with other Catalist IPOs”.

Mohamed Nasser Ismail, SGX’s head of SME development and listings, says the decision on what percentages of shares are offered via the public or placement channels is a commercial decision determined by the company and its advisors.

Monday 6 July 2015

China's stock markets are about to face a make-or-break week

China's stock markets may be facing a make-or-break week after officials rolled out an unprecedented series of steps at the weekend to prevent a full-blown stock market crash that could threaten the world's second-largest economy.

The government is anxiously awaiting the market opening on Monday to see if the new measures will halt a 30% plunge in the last three weeks, or if panicky investors who borrowed heavily to speculate on stocks will continue to sell.

An online survey by fund distributor eastmoney.com over the weekend, which polled over 100,000 individuals, said investors believed stock indexes would rise over 5% on Monday. But many of those polled don't think the bounce will last long.

“You’re going to need the central bank to open the floodgates to take us back to 4,500 points in Shanghai,” said an investment manager in Shanghai.

The Shanghai Composite Index was last at 4,500 on June 25, and it is now trading 22% lower.

China stocks had more than doubled in just 12 months even as the economy cooled and company earnings weakened, resulting in a market that even China's inherently bullish securities regulators eventually admitted had become too frothy.

china stock market dropChinaFotoPress/Getty Images

But the slide that began in mid-June, which the China Securities Regulatory Commission (CSRC) initially tried to downplay as a "healthy" correction after the fast run-up, has quickly shown signs of getting out of hand.

A surprise interest-rate cut by the central bank last week, relaxations in margin trading and other "stability measures" did little to calm investors, who sent shares down another 12% in the last week alone.

China's top leaders, who are already struggling to avert a sharper economic slowdown, seem to be losing patience.

FLURRY OF STEPS

In the first of a series of announcements on Saturday, China's top brokerages pledged that they would collectively buy at least 120 billion yuan ($19.3 billion) of shares to help steady the market, and would not sell holdings as long as the Shanghai Composite Index was below 4,500.

Later, the government also appeared to slam the brakes on the CSRC’s push to allow more companies to sell shares, which has threatened to dump even more supply on the market.

Twenty-eight companies that CSRC had approved to list shares all announced they had suspended their plans for initial public offerings (IPOs).

china marketsReuters

The U-turn is consistent with past IPO freezes in China when share markets were falling sharply, though they are usually spun as spontaneous company decisions, not as government directives.

Respondents to the eastmoney.com survey thought news of an IPO slowdown or freeze would be the most welcomed on Monday.

Late on Sunday, China state-owned investment company Central Huijin said it had recently been buying exchange-traded funds and would continue to do so.

The combined effect of the policies is to signal to China’s army of retail investors, who conduct around 85% of share transactions, that the government is now standing behind the stock market. But it is unclear whether even this will be enough to put a floor under prices or revive the rally.

Li Feng, a trader at Fortune Securities, said the amount of money that brokerages and fund managers vowed to put into the stock market is tiny compared with the size of leveraged positions still waiting to be unwound.

Some analysts suggest total margin lending, both formal and informal, could add up to around 4 trillion yuan.

Samuel Chien, partner of Shanghai-based hedge fund BoomTrend Investment Management Co, said he's ready to pile into blue-chip stocks this week, betting the new steps would trigger a rebound.

"Main indexes will rise. For the Shanghai Composite, the area below 4,500 is relatively safe now," Chien said. "I have ample cash at hand and surely will buy stocks this week."

But that perceived guarantee is a double-edged sword for regulators, given that many investors are just holding on long enough to cut their losses and leave the market.

People like Shao Qinglong, a public-service worker who has already lost over a quarter of his capital investing in stocks, told Reuters all he is waiting for is for the market to recover enough for him to break even.

"I didn't sell at the peak because people all say the market will rise beyond 6,000 points," Shao said. "I'm now waiting for the market to rebound so that I can get out."

The government is anxiously awaiting the market opening on Monday to see if the new measures will halt a 30% plunge in the last three weeks, or if panicky investors who borrowed heavily to speculate on stocks will continue to sell.

An online survey by fund distributor eastmoney.com over the weekend, which polled over 100,000 individuals, said investors believed stock indexes would rise over 5% on Monday. But many of those polled don't think the bounce will last long.

“You’re going to need the central bank to open the floodgates to take us back to 4,500 points in Shanghai,” said an investment manager in Shanghai.

The Shanghai Composite Index was last at 4,500 on June 25, and it is now trading 22% lower.

China stocks had more than doubled in just 12 months even as the economy cooled and company earnings weakened, resulting in a market that even China's inherently bullish securities regulators eventually admitted had become too frothy.

china stock market dropChinaFotoPress/Getty Images

But the slide that began in mid-June, which the China Securities Regulatory Commission (CSRC) initially tried to downplay as a "healthy" correction after the fast run-up, has quickly shown signs of getting out of hand.

A surprise interest-rate cut by the central bank last week, relaxations in margin trading and other "stability measures" did little to calm investors, who sent shares down another 12% in the last week alone.

China's top leaders, who are already struggling to avert a sharper economic slowdown, seem to be losing patience.

FLURRY OF STEPS

In the first of a series of announcements on Saturday, China's top brokerages pledged that they would collectively buy at least 120 billion yuan ($19.3 billion) of shares to help steady the market, and would not sell holdings as long as the Shanghai Composite Index was below 4,500.

Later, the government also appeared to slam the brakes on the CSRC’s push to allow more companies to sell shares, which has threatened to dump even more supply on the market.

Twenty-eight companies that CSRC had approved to list shares all announced they had suspended their plans for initial public offerings (IPOs).

china marketsReuters

The U-turn is consistent with past IPO freezes in China when share markets were falling sharply, though they are usually spun as spontaneous company decisions, not as government directives.

Respondents to the eastmoney.com survey thought news of an IPO slowdown or freeze would be the most welcomed on Monday.

Late on Sunday, China state-owned investment company Central Huijin said it had recently been buying exchange-traded funds and would continue to do so.

The combined effect of the policies is to signal to China’s army of retail investors, who conduct around 85% of share transactions, that the government is now standing behind the stock market. But it is unclear whether even this will be enough to put a floor under prices or revive the rally.

Li Feng, a trader at Fortune Securities, said the amount of money that brokerages and fund managers vowed to put into the stock market is tiny compared with the size of leveraged positions still waiting to be unwound.

Some analysts suggest total margin lending, both formal and informal, could add up to around 4 trillion yuan.

Samuel Chien, partner of Shanghai-based hedge fund BoomTrend Investment Management Co, said he's ready to pile into blue-chip stocks this week, betting the new steps would trigger a rebound.

"Main indexes will rise. For the Shanghai Composite, the area below 4,500 is relatively safe now," Chien said. "I have ample cash at hand and surely will buy stocks this week."

But that perceived guarantee is a double-edged sword for regulators, given that many investors are just holding on long enough to cut their losses and leave the market.

People like Shao Qinglong, a public-service worker who has already lost over a quarter of his capital investing in stocks, told Reuters all he is waiting for is for the market to recover enough for him to break even.

"I didn't sell at the peak because people all say the market will rise beyond 6,000 points," Shao said. "I'm now waiting for the market to rebound so that I can get out."

Friday 26 June 2015

How to be a Consistently Profitable Trader — Without Paying For Trading Courses

http://www.tradingwithrayner.com/how-to-be-a-consistently-profitable-trader-without-paying-for-trading-courses/

You’re frustrated.

You’re frustrated.

After reading countless books, attending trading courses, and trading for years, you are not consistently profitable.

I’ve been there myself. Going round in circles for years till one day, something clicked.

It isn’t about the latest trading indicator, predicting fundamental news or having the fastest internet connection.

So, what is it that separate the winners from losers?

You will want to read every word in this post. I will show you step by step to becoming consistently profitable, without spending a single cent.

The law of large number

Before anything else, you must understand the law of large number and how it affects your trading. But what is the law of large number?

The law of large numbers is a theorem that describes the result of performing the same experiment a large number of times. According to the law, the average of the results obtained from a large number of trials should be close to the expected value, and will tend to become closer as more trials are performed. – Probability Theory

As a trader, this means you need a large number of trades to allow your edge to play out in the markets.

You will not be consistently profitable every week, taking 5 trades a month. Why?

Because according to the law of large number, results are random in the short term, but will be closer to the expected value as more trials are performed.

Focus on whether what you are doing is right, not on the random nature of any single trade’s outcome. – Richard Dennis

What is consistency?

Since the law of large number requires a certain number of trades for your edge to play out, how does it affect your trading?

High frequency trading – Trading at very high frequency, like 10,000 trades a month. You can expect to be profitable every month, or everyday like Virtu Financial.

Day trader – Trading an average of 3 – 5 times a day, you can expect to be profitable every quarter.

Swing/position trader – Trading an average of 5 – 15 times a month, you can expect to be profitable every year.

The more trades you put on during a shorter period of time, the faster your edge will play out. But without an edge in the markets, the more trades you put on will lead to blowing up your account even faster.

If you understand this, you are ahead of 90% of traders out there. Next, I will share with you the steps you can take to be consistently profitable.

Find your trading style

I don’t think traders can follow rules for very long unless they reflect their own trading style – Ed Seykota

The first step is to find a trading style that suits you. Not only that, it has to also fit your schedule. If you have a full time job, it does not make sense to be a day trader.

Since there are many trading styles adopted by different traders, what is the best way to find one that suits you?

I would encourage you to read ‘Market Wizards‘ as it interview successful traders with various trading styles. This way you can learn what works in the market, and pick one trading style that you like.

Once you have decided on a trading style that suits you, find out everything you can on it. (Assuming you want to adopt a trend following approach)

This includes:

Academic research papers – You can google academic research papers. E.g. Search for ‘trend following academic research papers’. These are useful research papers you can explore.

Books – Search for books relevant to your trading style. E.g. Search for ‘trend following’ on Amazon. Here are a list of books that I would highly recommend.

YouTube – Watch videos and learn the thought process of other traders. E.g. Search for ‘trend following’ on YouTube.

Google – You can always find hidden gem here. Like interviews, podcasts, or blogs related to trend following.

Social Media – You can connect with traders who are successful. Follow them on Twitter and Facebook etc. Some of the traders I follow are Steve Burns, Rolf, Uktrendfollower and Jon Boorman.

Now, use all these information you have and build a trading plan.

Develop your trading plan

A trading plan is a structure, or a set of guidelines, that defines your trading. It removes subjectivity in your trading, minimize the roller coaster emotions, and keeps you prepared at all times.

So, how do you develop a trading plan? Below are 6 essential questions that every trading plan must answer:

1. Risk management

You must know how much risk you are putting on each trade, and how it will change as your trading capital increase/decrease over time. What % of your account will you risk on each trade?

2. When to enter

You need to define how you will enter a trade. What are the conditions required to put on a trade?

3. When to exit if you are wrong

Whenever you enter a trade, you must know the point at which you are wrong, and get out. Which is the point on the chart that will prove your wrong?

4. When to exit if you are right

When price goes in your favor, you must know how you will exit your trade. Would you trail your stops or set a profit target ahead of time? Would you look to take partial or full profit?

5. Markets traded

You must know which markets you will be trading. Would you trade all markets, or just trade a certain sector?

6. Time frame traded

You must know the time frame you are executing your trades. For day traders, you would be trading lower time frames like 5 minutes. For swing/position trader, you would be trading higher time frames like 4 hour or daily. Which time frame will you enter your trades?

Disclaimer: Below is a sample trading plan that I came up with randomly, please do your own due diligence.

Sample trading plan

I like to use the IF THEN syntax in my trading plan. It helps keep me more objective with lesser room for discretion.

If I am trading, then I will only trade Eurusd and Audusd. (The markets you are trading)

If I place a trade, then I will not lose more than 1% of my account. (Your risk management)

If 100 EMA is above 200 EMA on daily, then the trend is bullish. (Conditions before entering a trade and time frame you are trading)

If trend is bullish, then identify area of support where price can retrace to. (Conditions before entering a trade)

If price retrace to your area of support, then wait for a higher close. (Conditions before entering a trade)

If price close higher, then enter long at next candle open. (Entry)

If you are long, then place your stop loss below the low of the candle, and take profit at swing high. (Exit when you’re wrong, and when you’re right)

Plan your trades. Trade your plan. – Linda Rasckhe

Execute your trading plan

Once you have completed your trading plan, then forward test it in the live markets.

You can either forward test it on demo, or live account. I would suggest trading micro lots on your live account, so you can take into account how psychology affects your trading.

You have to execute your trades consistently according to your trading plan. This is where your discipline comes into play, only taking trading setups that meet your trading plan.

Warning 1: If you entering trades based on how you feel instead of following your trading plan, then it would be impossible to tell whether your trading plan has an edge in the markets.

Warning 2: Do not change your trading plan, or jump onto another trading system when you are having a series of losses. (I know you are tempted to do so)

Recall earlier the law of large number? Results are random in the short term, but will be closer to the expected value as more trials are performed.

This means if you change your trading plan after a few losing trades, you will never know if you have an edge in the markets. And you will be running around in circles forever!

I would recommend having a sample size of at least 100 trades, before deciding whether your trading plan has an edge in the markets.

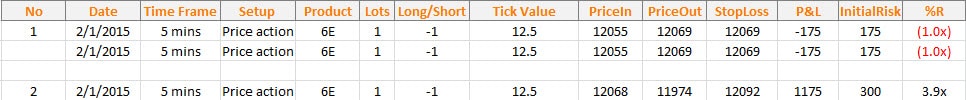

Record down your trades

Executing your trades consistently isn’t enough. You must record down your trades to collect relevant statistical data. Why?

So you can make an objective conclusion and know whether your trading plan has an edge in the markets.

You can easily do this on an excel spreadsheet with the relevant metrics below:

Date – Date when your trade is entered

Time Frame – The time frame you are entering on

Setup – The trading setup that trigger your entry

Product – Financial product that you trade E.g. Apple, Gold, Eur/usd

Lots – Position size you entered

Long/short – Direction of your trade

Tick value – Value per pip. E.g. 1 standard lot of Eurusd is $10/pip

Price In – Price you enter your trade

Price Out – Price you exited, at profit or loss

Stop loss – Price where you will exit your trade if wrong

Profit & loss – Profit or loss from this trade

Initial Risk in $ – Nominal risk value of this trade

R – Your initial risk of this trade. E.g If you made 2 times your initial risk, you made 2R

An example below

However if you want a free trading journal that automates everything, you can check outMyFxBook or FxBlue.

Review your trades

After you have a sample size of 100 trades, you can look to review your statistics to see whether you have an edge in the markets.

The most important trading equation you must know:

Expectancy = (Winning % * Average win) – (Losing % * Average loss) – (Commission + slippage)

If you have a positive expectancy, congratulations! You have an edge in the markets.

But what if you don’t have?

You can consider:

Increase your winning % – Be more selective with your entries. Look for other confluence factors that can be added to your trading plan.

Increase your average win – Ride your winners longer. You can do this by trailing your profits as price move in your favor.

Decrease your average loss – Cut your losses. You can do this by cutting your losers quickly.

Note: If you do not have an edge in the markets, increasing your frequency of trades will not make you profitable. It will only make you lose faster than before.

Likewise, reducing your risk per trade, will still cause you to lose, but at a slower pace.

Once you have identified the issues and come up with a solution, then repeat the entire process over again. Develop >> Execute >> Record >> Review

Unfortunately there is no one size fits all. Different traders would encounter different issues with their trading plan, and it is your duty to find out what to fix.

Conclusion

I have laid out step by step on what you must do as a trader, to be consistently profitable. If you follow this methodology, you will greatly improve your odds of being a consistently profitable trader.

Remember DERR, Develop >> Execute >> Record >> Review

So, how else can you become a consistently profitable trader?

Subscribe to:

Posts (Atom)