Attempting To Grasp A Whole New World Without Cheap Money!

By Gabriel Gan

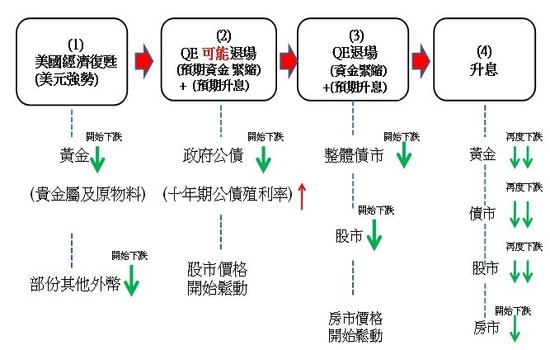

A fortnight ago, we witnessed the worse correction in more than a year after Fed Chairman Ben Bernanke breathed words of a gradual withdrawal of stimulus measures. Already so used to life in the stock market with cheap money, investors sold shares, bonds and gold so much so that buyers who had missed the entire rally refused to bargain hunt.

When Bernanke came out to utter comforting words, the stock markets rallied believing that it was a miscommunication that had led to the selloff. The Dow Jones Industrial Average (DJIA) attempted a rally from below 15,000 to as high as 15,340 before falling again when Ben Bernanke, in his post-FOMC meeting media conference, confirmed that the Fed would reduce the amount of bond-buying this year followed by a total withdrawal of Quantitative Easing (QE) III by mid of 2014 should the US unemployment figure hit 7 percent.

This rattled investors into selling as the DJIA plunged from a high of more than 15,300 before the Fed meeting to as low as 14,551 in a matter of just three trading days. The 800-point swing is still considered mild when compared to other markets, especially China and Hong Kong.

From peak to trough in the month of June alone, the Shanghai Composite Index (SSE) lost almost 450 points – a whopping 19.4 percent – and would have fallen into the bear market if not for the strong intra-day rebound on 25 June when it recovered from 100 points down to close at 1,959! If we were to take the closing of 2,421 points on 18 February and compare it against the close on 26 June, then the index is precariously close to a bear market. If the index breaks 1,936 points, then the index would have lost 20 percent from the high of 2,421 points.

As for Hong Kong, the Hang Seng Index (HSI) reached a high of 23,685 on 4 February and fell all the way to 19,855 on 25 June, representing a monstrous 3,830-point drop or 16.1 percent. From the recent closing high of 23,493 on 20 May, the index fell 3,053 points to close at 20,440 on 27 June. While the HSI has yet to fall into bear market territory, it is also dangerously close to that level despite a rebound that started on 25 June.

Why The Correction?

There are two main factors that contributed to the correction: Firstly, the world is very used to government intervention in the financial markets so much so that we can safely attribute the 4 1/2 year Bull Run to an unprecedented amount of money being printed by the US central bank.

A lot of money has been printed but it does not seem that much has gone to help the economy outside of the financial markets. Money that has been printed has been used to buy up bonds, stocks but precious little has been invested in the real economy. The main aim of the stimulus measures has been to artificially deflate interest rates so that credit is available cheaply to those who need it although those who really need it do not have access to such funds. When so much money is in the financial system, funds are then parked in assets from silver to gold to stocks and bonds. Investors who are tired of the miserable returns on risk-free deposits are forced to seek higher returns via riskier assets. The appetite for risks has helped to fuel a Bull Run despite the economy not doing spectacularly well.

This has changed, and will change very soon after Ben Bernanke’s latest comments. The Fed chief has finally decided to stop serving alcohol and investors who have been in a drunken stupor all these while have finally sobered up and realised that we are facing a whole new world.

This whole new world has been made worse by the fact that China – the fastest-growing economy in the world for the last decade – will no longer be growing at the same pace and may not even grow at the pace anticipated by China’s government.

The sudden credit crunch in China has led to a sharp rise in the interbank borrowing rate, pushing up interest rate amid an environment where the government continues – and will continue – to drain off money supply in the financial system after learning its lesson in the previous stimulus exercise whereby inflation shot to the sky.

The key reason for the stock market’s weak performance was largely due to the fact that investors had earlier expected the new leaders to boost the economy but, instead of meeting expectations, Premier Li Keqiang decided to restructure the economy by relying less on exports, boost domestic consumption and wean the economy off its reliance on readily available credit that proved to be detrimental to the economy in the long run.

Now that US is readying itself for life without stimulus and China adapting to a whole new world of economic restructuring and slower growth, it will take the wind out of the sails of the stock market for quite a while until investors adapt to the paradigm shift. This paradigm shift, while painful in the short-term, is actually a positive for the global economy as a whole because the world cannot be surviving more printed money and ballooning national debts.

When the real economy is ready to stand on its own feet without crutches provided by stimulus measures, it will ultimately benefit the stock market. This is the time when economic growth is real and solid, backed by fundamentals and probably more consistent with reality.

Key Supports And Resistances

If we were to look at the DJIA, it does not seem that the impending end of QE III has done much harm. After falling to a low of 14,551 – the new support level for the DJIA in the near-term – the index is now at 15,024 points. It has met a minor resistance at the 9-day moving average and unless the index can move above 15,300, investors should not bet on the DJIA moving into a new uptrend.

While the US market looks rather strong despite it being the “epicenter of the earthquake”, Asian markets have suffered the most

For China and Hong Kong, they almost fell into bear market territory but are now enjoying a good spell after the People’s Bank of China acted to ease the credit crunch by injecting liquidity into areas where money is needed. It is also helped by certain Fed officials who are quick to downplay Bernanke’s earlier stance that QE III will be reduced by this year and put to a stop by next year. These officials quickly reassured that Bernanke’s statement was meant to say that QE III will end only if the economy was strong enough to stand on its own.

The HSI has staged a V-shaped rebound and continues to rise on 28 June after the DJIA staged a triple-digit rebound. The index may face some resistance at between 21,000-21,200 after rallying for a couple of days and owing to the weak sentiment. Support remains at the recent low of 19,426 points.

The weakest rebound took place in Singapore with the STI rising very little from its recent low and the overall market weak. It is unlikely that the index can go above the recent high of 3,235, as it is already struggling to overcome the resistance zone at between 3,150 to 3,180.

It will take time for the world to get used to slower growth and, most importantly, life without a stimulus measure. We cannot be sure that once the stimulus measures have been withdrawn, the economy can stand on its own but, as already mentioned, it is for the long-term good.

Source/Extract/Excerpts/来源/转贴/摘录: http://www.sharesinv.com/

Publish date: 28/06/13