http://www.tradingwithrayner.com/how-to-be-a-consistently-profitable-trader-without-paying-for-trading-courses/

You’re frustrated.

You’re frustrated.

After reading countless books, attending trading courses, and trading for years, you are not consistently profitable.

I’ve been there myself. Going round in circles for years till one day, something clicked.

It isn’t about the latest trading indicator, predicting fundamental news or having the fastest internet connection.

So, what is it that separate the winners from losers?

You will want to read every word in this post. I will show you step by step to becoming consistently profitable, without spending a single cent.

The law of large number

Before anything else, you must understand the law of large number and how it affects your trading. But what is the law of large number?

The law of large numbers is a theorem that describes the result of performing the same experiment a large number of times. According to the law, the average of the results obtained from a large number of trials should be close to the expected value, and will tend to become closer as more trials are performed. – Probability Theory

As a trader, this means you need a large number of trades to allow your edge to play out in the markets.

You will not be consistently profitable every week, taking 5 trades a month. Why?

Because according to the law of large number, results are random in the short term, but will be closer to the expected value as more trials are performed.

Focus on whether what you are doing is right, not on the random nature of any single trade’s outcome. – Richard Dennis

What is consistency?

Since the law of large number requires a certain number of trades for your edge to play out, how does it affect your trading?

High frequency trading – Trading at very high frequency, like 10,000 trades a month. You can expect to be profitable every month, or everyday like Virtu Financial.

Day trader – Trading an average of 3 – 5 times a day, you can expect to be profitable every quarter.

Swing/position trader – Trading an average of 5 – 15 times a month, you can expect to be profitable every year.

The more trades you put on during a shorter period of time, the faster your edge will play out. But without an edge in the markets, the more trades you put on will lead to blowing up your account even faster.

If you understand this, you are ahead of 90% of traders out there. Next, I will share with you the steps you can take to be consistently profitable.

Find your trading style

I don’t think traders can follow rules for very long unless they reflect their own trading style – Ed Seykota

The first step is to find a trading style that suits you. Not only that, it has to also fit your schedule. If you have a full time job, it does not make sense to be a day trader.

Since there are many trading styles adopted by different traders, what is the best way to find one that suits you?

I would encourage you to read ‘Market Wizards‘ as it interview successful traders with various trading styles. This way you can learn what works in the market, and pick one trading style that you like.

Once you have decided on a trading style that suits you, find out everything you can on it. (Assuming you want to adopt a trend following approach)

This includes:

Academic research papers – You can google academic research papers. E.g. Search for ‘trend following academic research papers’. These are useful research papers you can explore.

Books – Search for books relevant to your trading style. E.g. Search for ‘trend following’ on Amazon. Here are a list of books that I would highly recommend.

YouTube – Watch videos and learn the thought process of other traders. E.g. Search for ‘trend following’ on YouTube.

Google – You can always find hidden gem here. Like interviews, podcasts, or blogs related to trend following.

Social Media – You can connect with traders who are successful. Follow them on Twitter and Facebook etc. Some of the traders I follow are Steve Burns, Rolf, Uktrendfollower and Jon Boorman.

Now, use all these information you have and build a trading plan.

Develop your trading plan

A trading plan is a structure, or a set of guidelines, that defines your trading. It removes subjectivity in your trading, minimize the roller coaster emotions, and keeps you prepared at all times.

So, how do you develop a trading plan? Below are 6 essential questions that every trading plan must answer:

1. Risk management

You must know how much risk you are putting on each trade, and how it will change as your trading capital increase/decrease over time. What % of your account will you risk on each trade?

2. When to enter

You need to define how you will enter a trade. What are the conditions required to put on a trade?

3. When to exit if you are wrong

Whenever you enter a trade, you must know the point at which you are wrong, and get out. Which is the point on the chart that will prove your wrong?

4. When to exit if you are right

When price goes in your favor, you must know how you will exit your trade. Would you trail your stops or set a profit target ahead of time? Would you look to take partial or full profit?

5. Markets traded

You must know which markets you will be trading. Would you trade all markets, or just trade a certain sector?

6. Time frame traded

You must know the time frame you are executing your trades. For day traders, you would be trading lower time frames like 5 minutes. For swing/position trader, you would be trading higher time frames like 4 hour or daily. Which time frame will you enter your trades?

Disclaimer: Below is a sample trading plan that I came up with randomly, please do your own due diligence.

Sample trading plan

I like to use the IF THEN syntax in my trading plan. It helps keep me more objective with lesser room for discretion.

If I am trading, then I will only trade Eurusd and Audusd. (The markets you are trading)

If I place a trade, then I will not lose more than 1% of my account. (Your risk management)

If 100 EMA is above 200 EMA on daily, then the trend is bullish. (Conditions before entering a trade and time frame you are trading)

If trend is bullish, then identify area of support where price can retrace to. (Conditions before entering a trade)

If price retrace to your area of support, then wait for a higher close. (Conditions before entering a trade)

If price close higher, then enter long at next candle open. (Entry)

If you are long, then place your stop loss below the low of the candle, and take profit at swing high. (Exit when you’re wrong, and when you’re right)

Plan your trades. Trade your plan. – Linda Rasckhe

Execute your trading plan

Once you have completed your trading plan, then forward test it in the live markets.

You can either forward test it on demo, or live account. I would suggest trading micro lots on your live account, so you can take into account how psychology affects your trading.

You have to execute your trades consistently according to your trading plan. This is where your discipline comes into play, only taking trading setups that meet your trading plan.

Warning 1: If you entering trades based on how you feel instead of following your trading plan, then it would be impossible to tell whether your trading plan has an edge in the markets.

Warning 2: Do not change your trading plan, or jump onto another trading system when you are having a series of losses. (I know you are tempted to do so)

Recall earlier the law of large number? Results are random in the short term, but will be closer to the expected value as more trials are performed.

This means if you change your trading plan after a few losing trades, you will never know if you have an edge in the markets. And you will be running around in circles forever!

I would recommend having a sample size of at least 100 trades, before deciding whether your trading plan has an edge in the markets.

Record down your trades

Executing your trades consistently isn’t enough. You must record down your trades to collect relevant statistical data. Why?

So you can make an objective conclusion and know whether your trading plan has an edge in the markets.

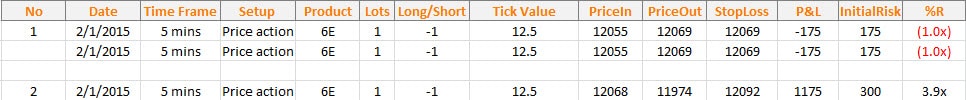

You can easily do this on an excel spreadsheet with the relevant metrics below:

Date – Date when your trade is entered

Time Frame – The time frame you are entering on

Setup – The trading setup that trigger your entry

Product – Financial product that you trade E.g. Apple, Gold, Eur/usd

Lots – Position size you entered

Long/short – Direction of your trade

Tick value – Value per pip. E.g. 1 standard lot of Eurusd is $10/pip

Price In – Price you enter your trade

Price Out – Price you exited, at profit or loss

Stop loss – Price where you will exit your trade if wrong

Profit & loss – Profit or loss from this trade

Initial Risk in $ – Nominal risk value of this trade

R – Your initial risk of this trade. E.g If you made 2 times your initial risk, you made 2R

An example below

However if you want a free trading journal that automates everything, you can check outMyFxBook or FxBlue.

Review your trades

After you have a sample size of 100 trades, you can look to review your statistics to see whether you have an edge in the markets.

The most important trading equation you must know:

Expectancy = (Winning % * Average win) – (Losing % * Average loss) – (Commission + slippage)

If you have a positive expectancy, congratulations! You have an edge in the markets.

But what if you don’t have?

You can consider:

Increase your winning % – Be more selective with your entries. Look for other confluence factors that can be added to your trading plan.

Increase your average win – Ride your winners longer. You can do this by trailing your profits as price move in your favor.

Decrease your average loss – Cut your losses. You can do this by cutting your losers quickly.

Note: If you do not have an edge in the markets, increasing your frequency of trades will not make you profitable. It will only make you lose faster than before.

Likewise, reducing your risk per trade, will still cause you to lose, but at a slower pace.

Once you have identified the issues and come up with a solution, then repeat the entire process over again. Develop >> Execute >> Record >> Review

Unfortunately there is no one size fits all. Different traders would encounter different issues with their trading plan, and it is your duty to find out what to fix.

Conclusion

I have laid out step by step on what you must do as a trader, to be consistently profitable. If you follow this methodology, you will greatly improve your odds of being a consistently profitable trader.

Remember DERR, Develop >> Execute >> Record >> Review

So, how else can you become a consistently profitable trader?