Be decisive, Be patient, Don’t be greedy, Don't be stubborn

Disclaimer

如果要翻译这个网站,请使用google translate http://translate.google.com

The information contained in is provided to you for general information/circulation only and is not intended to nor will it create/induce the creation of any binding legal relations. The information or opinions provided do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should seek advice from a financial adviser regarding the suitability of the investment products mentioned, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to purchase the investment product. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest.

Any views, opinions, references or other statements or facts provided in this are personal views. No liability is accepted for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on the information provided herein.

Personal Data Protection Act (PDPA)

You would like this website to collect your personally identifiable information that can be used to contact or identify you (“Personal Data”). Personal Data may include, but is not limited to:

- Your name, email address and phone number.

You acknowledge and consent to our collection of your personal data for contacting you on the purposes listed below:

- Marketing, advertising and promotional purposes related to the content of this website

- Provision of products & services which you have requested for

Please note that you are entitled to withdraw your consent for the collection of your personal data at any point in time by providing a notification to ckchoy77@gmail.com.

Note:

All TA (Technical Analysis) view using charts are for illustration purpose only.

Unless otherwise specified, all charts' sources are from POEMS(Phillip Online Electronic Mart System)

Thursday 31 July 2014

Tuesday 29 July 2014

How much is Chip Eng Seng undervalued by Mr Market?

http://www.puntersgallery.com/showthread.php?t=207&highlight=chip

Chip Seng Seng is very undervalued. The Alexandra Central project alone is likely to increase its NAV by at least 60 cents.

Management bought back millions of shares at 0.74 to 0.76 cents. Current Market price is 0.805. Hence, Market Cap works out to be $516mil.

Did anyone estimate the obscene profit CES will reflect in its book in the coming few quarters?

I did some rough calculation using just one of its projects, Alexandra Central. It seems that just one major project can already create enough NAV to cover its current market cap.

a. 450 hotel rooms x $1mil per key = $450 mil (Valuation)

b. Commercial retail space = 90,000sqf x $5233 (source: property guru)PSF x 80% (efficiency ratio) = $377mil (REVENUE)

c. Total cost of investment = $320mil (land, construction, etc)

(land cost = $189mil. The construction contract was awarded to Keong Hong for $101mil). [$350mil might have been "overstated" at company's website]

Shareholder value from this single project alone ~ $507mil , which is close to its current market cap (yet to be recognized in its books), based on very conservative assumptions!

And this is just one project and there are many others (Nine residence/Junction 9, progressively recognized, etc). Its construction business will earn about EPS 5 cents per annum.

The current NTA of around 80 cents seem to be grossly understated. Given that company was buying furiously at 75.5 cents on average, it could not be just for a meager 10-20% gain (IMHO). In fact, company is sending a very clear and strong signal to its loyal shareholders.

The total intrinsic value by end of FY2015 would probably in the region of $1.60~$1.80 (very conservative, excluding TM and other pipe projects such as the Malacca retail/hotel, Fulcrum, Doncaster project in Melbourne)

Friday 25 July 2014

Stocks screen 25/07/2014

Hafary dividend play, yield >10%

renovation play in Singapore. BTO completion renovation demand till 2017

KLW, strong doors demand, driven by BTO completion till 2017

renovation play in Singapore. BTO completion renovation demand till 2017

KLW, strong doors demand, driven by BTO completion till 2017

Saturday 12 July 2014

A Day In The Life Of A Day Trader

http://www.investopedia.com/articles/professionals/052113/day-life-day-trader.asp

A Day In The Life Of A Day Trader

Traders participate in the financial markets by buying and selling stocks, futures, forex and other securities, and closing out positions with the intention of making small, frequent gains. Just as there are many types of investors, traders range from the small, independent trader working from a home office to the institutional player who moves tens or hundreds of millions of dollars worth of shares and contracts each trading session.

Traders and Trading Styles

Traders are further defined by the timeframe in which they open and close positions (the holding period), and the method by which they find trading opportunities and send orders to the market. Discretionary traders are decision-based traders who scan the markets and place manual orders in response to information that is available at that time. System traders, on the other hand, use some level of automation to implement an objective set of rules, allowing a computer to both scan for trading opportunities and handle all order entry activity. The chart below lists the different trading styles with the corresponding timeframe and method for each.

Because of this diversity among traders, there really is no such thing as a "typical" day in the life of a trader. With that in mind, let's take a look at what a day may be like for an individual, discretionary day trader, since this is where many people begin trading.

Pre-Market

Before the markets spring to life at 9:30 a.m. EST, most day traders are busy catching up on any events that happened overnight that could affect that day's trading session, coffee and breakfast in hand. This involves reading stories from various newspapers and financial web sites, as well as listening to updates from financial news networks, such as CNBC and Bloomberg. The futures markets, as well as the broad market indexes, are noted as traders form opinions about the direction they expect the market to trend. Traders will also review economic calendars to find out which market-moving financial reports – such as the weekly petroleum status report – are due that day. It should be noted that many traders participate in round-the-clock markets, such as futures and forex, and these traders can expect increased volume before the rest of the markets open at 9:30.

After reading about events and making note of what the analysts are saying, traders head to their workstations, turn on their computers and monitors, and open up their analysis and trading platforms. A lot of layers of technology are at work here, from the trader's computer, keyboard and mouse, to the Internet, trading platform, broker and ultimately the exchanges themselves. As such, traders spend time making sure that everything on their end is functioning correctly before the trading session begins.

If everything is working properly, traders start scanning the markets for potential trading opportunities. Some traders work just one or two markets (such as two stocks or two e-minis), and will open up these charts and apply selected technical indicators to see what's going in those markets. Others use market scanning software to find securities that meet their exact specifications. For example, a trader might scan for stocks that are trading above their 52-week highs, with at least 4,000,000 in volume and with a minimum price of $10.00. Once the computer compiles a list of stocks that meet these criteria, the trader will put these tickers on his or her watch list.

Early Trading

The first half-hour of trading is typically pretty volatile, so many (but certainly not all) individual traders sit on the sidelines to give the market time to settle and avoid being instantly stopped out of a position. Now it's a waiting game, while traders watch for trading opportunities that are based on their trading plans, experience, intuition, and current market activity. Precision and timing become increasingly important the shorter the holding period for the trade and the smaller the profit target. Once an opportunity arises, the trader must act quickly to identify the set up and pounce on the trade – seconds can make the difference between a winning and losing trade.

The trader uses an order entry interface to submit orders to the market. Many traders will also submit simultaneous orders for profit targets and stop losses to protect against adverse price moves. Depending on the trader's goals, he or she will either wait for this position to close out before entering another one, or will continue scanning the markets for additional trading opportunities. Many traders look for late morning reversal opportunities. Since trading volume and volatility diminish as mid-day approaches, most traders will hope that any positions will reach their profit targets before lunch. Otherwise, the next couple hours can be rather uneventful (and boring) as the big money is out to lunch and the markets slow down.

Second Wind

Once the institutional traders are back from lunch and meetings, the markets pick up and volume and price movement once again comes to life. Traders take advantage of this second wind, looking for additional trading opportunities before the markets close at 4:00. Any positions entered during the morning will have to be closed before the end of the day, as will any positions that are taken now, so traders are keen to get in trades as soon as possible so they have time to reach a profit target before the session's end.

Traders continue to monitor their open positions and look for any more opportunities. Because day traders do not hold their positions overnight, many set a time limit past which they will not open any additional positions (such as 3:30 p.m., for example). This helps ensure that the trade will have enough time to make a profit before the markets close. As 4:00 approaches, the trader closes all open positions and cancels any unfilled orders. This is an important step, since open orders can get filled without the trader realizing it, resulting in potential losses. The trader will close the day with a profit, at breakeven, or with a loss. Either way, it's just another day at the office, and seasoned traders know to neither celebrate large wins nor cry about losses. To traders, it's what happens over time – in terms of months and years – that matters.

Post Market

After the markets close, traders finish up the day by reviewing their trades, making note of what went well and what could have been done better. Many discretionary traders use a trading journal – a written log of all trades, including ticker symbol, set-up (why the trade was taken), entry price, exit price, number of shares, and any notes about the trade or what was going on in the market that may have affected the trade. If organized and consistently used, a trading journal can provide vital information to a trader looking to improve his or her plan and performance. Many traders will again listen to a financial news network to get a recap of the day and start making plans for the next trading session.

The Bottom Line

Outside of a day trader's pre and post-market day, a lot of time is spent on research – learning about the markets, experimenting with technical indicators and honing their order entry skills, using simulated trading platforms. Most traders likely have a story they can laugh at now about the time they hit "sell" instead of "buy," or when they entered 1000 shares instead of 100, or both.

Day trading has many advantages: you can be your own boss, set your own schedule, work from home and achieve unlimited profits. While we often hear about these perks, it's important to realize that day trading is hard work, and you could put in a 40 hour work week and end up with no "pay check." Day traders spend much of their days scanning the markets for trading opportunities and monitoring open positions, any many of their evenings researching and improving their trading plans. Because trading can be a very solitary endeavor, some traders choose to participate in trading "chat rooms" for social and/or educational purposes.

Traders and Trading Styles

Traders are further defined by the timeframe in which they open and close positions (the holding period), and the method by which they find trading opportunities and send orders to the market. Discretionary traders are decision-based traders who scan the markets and place manual orders in response to information that is available at that time. System traders, on the other hand, use some level of automation to implement an objective set of rules, allowing a computer to both scan for trading opportunities and handle all order entry activity. The chart below lists the different trading styles with the corresponding timeframe and method for each.

| Trading style | Timeframe (holding period) | Method |

| Position trading | Months to years | Discretionary or system |

| Swing trading | Days to weeks | Discretionary or system |

| Day trading | Day only – no overnight positions | Discretionary or system |

| Scalp trading | Seconds to minutes – no overnight positions | Discretionary or system |

| High frequency trading | Seconds to minutes | System only |

Because of this diversity among traders, there really is no such thing as a "typical" day in the life of a trader. With that in mind, let's take a look at what a day may be like for an individual, discretionary day trader, since this is where many people begin trading.

Pre-Market

Before the markets spring to life at 9:30 a.m. EST, most day traders are busy catching up on any events that happened overnight that could affect that day's trading session, coffee and breakfast in hand. This involves reading stories from various newspapers and financial web sites, as well as listening to updates from financial news networks, such as CNBC and Bloomberg. The futures markets, as well as the broad market indexes, are noted as traders form opinions about the direction they expect the market to trend. Traders will also review economic calendars to find out which market-moving financial reports – such as the weekly petroleum status report – are due that day. It should be noted that many traders participate in round-the-clock markets, such as futures and forex, and these traders can expect increased volume before the rest of the markets open at 9:30.

After reading about events and making note of what the analysts are saying, traders head to their workstations, turn on their computers and monitors, and open up their analysis and trading platforms. A lot of layers of technology are at work here, from the trader's computer, keyboard and mouse, to the Internet, trading platform, broker and ultimately the exchanges themselves. As such, traders spend time making sure that everything on their end is functioning correctly before the trading session begins.

Early Trading

The first half-hour of trading is typically pretty volatile, so many (but certainly not all) individual traders sit on the sidelines to give the market time to settle and avoid being instantly stopped out of a position. Now it's a waiting game, while traders watch for trading opportunities that are based on their trading plans, experience, intuition, and current market activity. Precision and timing become increasingly important the shorter the holding period for the trade and the smaller the profit target. Once an opportunity arises, the trader must act quickly to identify the set up and pounce on the trade – seconds can make the difference between a winning and losing trade.

The trader uses an order entry interface to submit orders to the market. Many traders will also submit simultaneous orders for profit targets and stop losses to protect against adverse price moves. Depending on the trader's goals, he or she will either wait for this position to close out before entering another one, or will continue scanning the markets for additional trading opportunities. Many traders look for late morning reversal opportunities. Since trading volume and volatility diminish as mid-day approaches, most traders will hope that any positions will reach their profit targets before lunch. Otherwise, the next couple hours can be rather uneventful (and boring) as the big money is out to lunch and the markets slow down.

Second Wind

Once the institutional traders are back from lunch and meetings, the markets pick up and volume and price movement once again comes to life. Traders take advantage of this second wind, looking for additional trading opportunities before the markets close at 4:00. Any positions entered during the morning will have to be closed before the end of the day, as will any positions that are taken now, so traders are keen to get in trades as soon as possible so they have time to reach a profit target before the session's end.

Traders continue to monitor their open positions and look for any more opportunities. Because day traders do not hold their positions overnight, many set a time limit past which they will not open any additional positions (such as 3:30 p.m., for example). This helps ensure that the trade will have enough time to make a profit before the markets close. As 4:00 approaches, the trader closes all open positions and cancels any unfilled orders. This is an important step, since open orders can get filled without the trader realizing it, resulting in potential losses. The trader will close the day with a profit, at breakeven, or with a loss. Either way, it's just another day at the office, and seasoned traders know to neither celebrate large wins nor cry about losses. To traders, it's what happens over time – in terms of months and years – that matters.

After the markets close, traders finish up the day by reviewing their trades, making note of what went well and what could have been done better. Many discretionary traders use a trading journal – a written log of all trades, including ticker symbol, set-up (why the trade was taken), entry price, exit price, number of shares, and any notes about the trade or what was going on in the market that may have affected the trade. If organized and consistently used, a trading journal can provide vital information to a trader looking to improve his or her plan and performance. Many traders will again listen to a financial news network to get a recap of the day and start making plans for the next trading session.

The Bottom Line

Outside of a day trader's pre and post-market day, a lot of time is spent on research – learning about the markets, experimenting with technical indicators and honing their order entry skills, using simulated trading platforms. Most traders likely have a story they can laugh at now about the time they hit "sell" instead of "buy," or when they entered 1000 shares instead of 100, or both.

Day trading has many advantages: you can be your own boss, set your own schedule, work from home and achieve unlimited profits. While we often hear about these perks, it's important to realize that day trading is hard work, and you could put in a 40 hour work week and end up with no "pay check." Day traders spend much of their days scanning the markets for trading opportunities and monitoring open positions, any many of their evenings researching and improving their trading plans. Because trading can be a very solitary endeavor, some traders choose to participate in trading "chat rooms" for social and/or educational purposes.

Thursday 10 July 2014

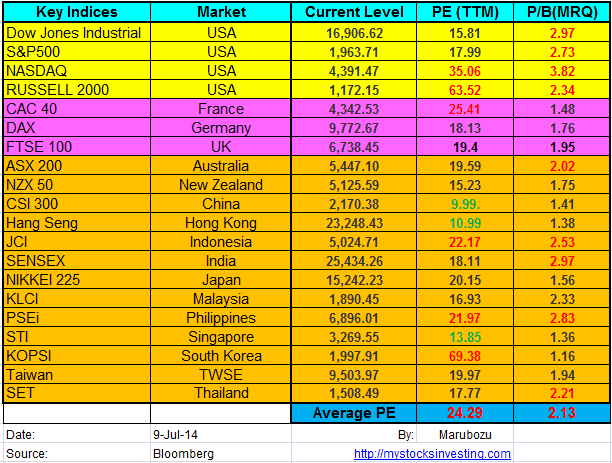

Global Stock Market Indices PE Ratio At a Glance (9 July 2014)

Sunday 6 July 2014

Psychological Capital

Trading After A Blow Up and Knowing Your Psychological Capital

05 Jul, 2014 Alvin Chow

How is life after that? Am I still trading? Some friends would ask.

Yes, I am. In fact, I resumed trading within a week. I topped up the account with US$10,000, a far cry from the amount I have lost.

I wasn’t used to the trade size at first and I fully understood how Tom Yuen felt when he resumed trading after his blow up. It was really negligible amount that you do not feel like trading. There is no kick to an alcoholic who could only drink a sip of beer.

But this is a punishment. Because I could not handle a big capital with my emotions acting up, so I must trade small. As the saying goes, “great powers come with great responsibilities”. I can also say, “large capital come with great emotional control”. It is not how much capital you have, but how well can you trade without getting emotionally affected. Let’s call this Psychological Capital.

Leverage Wants to Blow You Up

People are often attracted to trading because the returns are higher over a shorter period of time. And they can often do it with smaller capital.

To do so, the main source of profits have to come from leverage. If the price of a stock or forex pair moves 1-2% daily, you cannot force it to move more. The only way to increase your returns is to take leverage. We need to accept that making higher returns essentially means taking more leverage. Just like property investing, the main source of returns is leverage. Strip out the leverage and property returns looks average.

If you have to take leverage, you stand a chance to blow up. Below is the table to illustrate my point. If you have taken just 2 times leverage, a 50% move against your position would have blew up your account. Hence, you would have less tolerance for volatility going against you. And to make things worse, traders tend to choose instruments that move more – so they do not have to wait that long to see results and technical analysis work better with price movements.

Hence, it is not that trading is risky. It is risky if you have taken leverage.

There are ways to protect you – position sizing and cutting losses. You would have read numerous literature and listened to enough gurus preaching about these two important tenets of trading. They exist because of leverage. Because there is a chance to blow up your account, you need to chop off your limb before the poison gets to your brain and kill you.

Psychological Capital

Easy to say – position size, cut loss, follow the rules.

To do all these requires big Psychological Capital. I do not believe that discipline is a solution. The key is to find out how much capital you can trade without you panicking when things go wrong.

For example, I know my Psychological Capital is between US$10,000 to US$85,000. The latter is how much I blew up. I can never trade that amount and maintain my sanity. You should have seen how I was procrastinating cutting losses in Jan. I do not know my exact threshold yet, but at least I have established a range. I can tell you that trading US$10,000 was a breeze for me. I had no problems cutting losses for the past week and that is what trading should be. You do not FREEZE when you need to take actions.

Here are my results since the disastrous January (all in USD):

- Jan: -$84,496.25

- Feb: +$1,680

- Mar: +$1,138

- Apr: +$1,460

- May: +$1,732.50

- Jun: -$699.17

Trading is a risky game because of leverage. To execute the cut loss properly, we need to trade below our Psychological Capital.

Have you figured out your Psychological Capital? If yes, are you trading below it?

Tough times for brokers as trades slow, commissions fall

http://business.asiaone.com/news/tough-times-brokers-trades-slow-commissions-fall

Jonathan Kwok

The Straits Times

Wednesday, Jun 25, 2014

SINGAPORE- Singapore remisier Jimmy Ho remembers the good old days of stock trading when the action came thick and fast and the cash was free-flowing.

"It was very good. You'd answer the phone with your left ear until it became heated and you would have to change to your right ear," said Mr Ho, as he reminisced about the early days of his 20-year career.

"For some remisiers, they could do $100,000 a month in commissions during a bull run."

These days, remisiers like Mr Ho, who is also the president of the Society of Remisiers (Singapore), have a quieter existence, tapping away at the keyboard while monitoring the stock market on multiple screens.

A few times a day, a client calls for help with trades but most deals are done with a click of a button by the clients themselves.

The cash has also dried up, said Mr Ho. "I don't have the exact figures, but my estimation is that more than half of the remisiers earn less than $1,000 (a month, in commissions) nowadays."

The sharp slowdown in business these days is partly due to the World Cup and June school holidays, which bring down volumes on the market.

"Trading activity was low before, but now with the World Cup, it's lower than low," he mused.

Another reason for the slowdown has been the fallout from the penny stock crash.

Penny stocks, which are cheap to buy, used to be a good source of revenue as many small-time punters would do quick trades, resulting in higher volumes and commissions for remisiers.

But after Blumont Group, LionGold Corp and Asiasons Capital rose to record highs before crashing spectacularly last October, retail investors have shied away from such counters.

In turn, commissions earned by brokers have dropped by between 15 per cent and 40 per cent, brokers told The Straits Times.

The industry has been on a long and steady decline, battered by regulatory changes, technological advances and rising competition.

Five years ago, the daily average turnover in May 2009 was $2.27 billion.

Today, the local market's daily average securities turnover is just half of that, standing at $1.17 billion last month.

Changes in regulation have also hit remisiers hard. In December 1999, the Singapore Exchange (SGX) was formed by the merger of the Stock Exchange of Singapore, Singapore International Monetary Exchange, and Securities Clearing and Computer Services.

That came alongside a raft of changes which increased competition in the stockbroking industry and saw commissions slashed.

The changes were good for investors but very bad for remisiers.

Commissions for a remisier are now as low as $10 for an online trade, after deducting the cut to the brokerage firm.

This means brokers will need their clients to make 100 online trades a month to hit the $1,000 mark. But activity has dropped off so much that many struggle to hit that target, said remisiers.

New forms of trading products and services from non-conventional brokers are also making the landscape more competitive.

The growth of contracts for difference has also taken business away from remisiers.

These investment tools provide traders with a quick and easy way to take bets on the direction of the stock without needing to put a large amount of capital down.

Some remisiers still try to set themselves apart, with the trading advice and ideas they provide to their clients.

But some investors - particularly younger ones - prefer to trade and invest by themselves, without the input of their brokers, said remisiers.

It is no wonder Mr Ho feels the future is bleak, with fewer young remisiers joining the industry.

"When they see the situation is like this, the fresh graduates stay away," he said.

Brokers such as Mr Desmond Leong, with about 10 years in the trade, are now turning to trading their own money as means to support themselves and to rely less on commissions.

"The clients aren't providing a lot of brokerage (fees), I've got to bump up my own trading. That's the reality for a lot of the remisiers," said the 35-year-old.

Proposed changes from regulators, who want to stop a practice which allows investors to trade shares without putting up actual capital, could lead to further repercussions.

The end could be near for unsecured "contra trading", which will reduce the credit risk for remisiers - but also further dampen trading activity.

Some brokers are not sticking around to find out.

"A number of remisiers have quit the industry," said 26-year- old Alvin Yong, who has been in the business for three years and is one of the few young faces in the trading room.

Also, a major bugbear among remisiers is the dropping of a midday break by SGX, which was initiated in 2011.

Said Mr Yong: "Who wants to go into a job with no lunch break?"

Friday 4 July 2014

Journal 2014/07/04 HSI

Previous data: US market at record high and Dow surpassed 17L gain

Morning HSI futures pointing to gain.

Upon open, scalped it based on HK top 2 to 3 weighting counters move. Range bound play.

Morning HSI futures pointing to gain.

Upon open, scalped it based on HK top 2 to 3 weighting counters move. Range bound play.

Wednesday 2 July 2014

Journal 2014/07/02 HSI

Previous data: Dow gain 129 or 0.77%. Chinese PMI good. HSI futures closed at about 23155 level.

This morning HSI preopen: HSI futures pointing to about +100. Top 2 weighted counters ie HSBC(14.75%) and Tencent(8.18%)HSI weighting about 1 to 2% gap up --> looks bullish. Long call about HSI +100 level.

Upon HSI futures open on 9.15am, true enough HSI gapped up more than expected. about +200 or near to 2%. And profit taking slowly kicked in. I was following the trend as well to take profit and closed position at 7% net gain.(net means after deduct comm)

But then the story not end and at 9.36am bottom, HSI ramped up and surpassed morning high. Another crazy action. HSI is very sensitive, domino effect always apply. And till now the profit would have grown to 14%(vs my 7% closed). There is Chinese saying:输要缩, 赢要谷 (lose must cut, Win must add) This sounds quite similar to trader's golden rule: cut loses and let profits run. And again and again, today's actions proved this saying is wonderful just that I have not been able to practise it.

To watch 11am action, if any. What is 11am timing? Market close for lunch break at 12 noon and close at 4pm. Hence any trend usually will establish about near the closings ie at about 11-11.30am and 3-3.30pm, where traders rush to position themselves in the majority trend ( up or down ).

This morning HSI preopen: HSI futures pointing to about +100. Top 2 weighted counters ie HSBC(14.75%) and Tencent(8.18%)HSI weighting about 1 to 2% gap up --> looks bullish. Long call about HSI +100 level.

Upon HSI futures open on 9.15am, true enough HSI gapped up more than expected. about +200 or near to 2%. And profit taking slowly kicked in. I was following the trend as well to take profit and closed position at 7% net gain.(net means after deduct comm)

But then the story not end and at 9.36am bottom, HSI ramped up and surpassed morning high. Another crazy action. HSI is very sensitive, domino effect always apply. And till now the profit would have grown to 14%(vs my 7% closed). There is Chinese saying:输要缩, 赢要谷 (lose must cut, Win must add) This sounds quite similar to trader's golden rule: cut loses and let profits run. And again and again, today's actions proved this saying is wonderful just that I have not been able to practise it.

To watch 11am action, if any. What is 11am timing? Market close for lunch break at 12 noon and close at 4pm. Hence any trend usually will establish about near the closings ie at about 11-11.30am and 3-3.30pm, where traders rush to position themselves in the majority trend ( up or down ).

Subscribe to:

Posts (Atom)